|

|

IT Outsourcing in Global Banking – Service Provider Landscape with PEAK Matrix™ Assessment 2017 and Profiles Compendium

30 Jun 2017

by

Aaditya Jain, Archit Mishra, Jimit Arora, Ronak Doshi

The banking industry is undergoing transition, triggered by rapidly-changing customer demands, challenging operating environment, and disruption in technologies. Banking in the future will no longer be dependent on branches and will be ubiquitous through multiple digital channels and devices. In 2016, banks made massive investments to transform their business into digital, which has impacted not just the service providers and the technology firms but also the FinTechs they invested in, partnered with, or acquired.

As the market decelerated, service providers witnessed moderate growth. The industry witnessed consolidation resulting in synergy gains and scale benefits to smaller players. As parallel demand emerged for implementing new digital technologies and modernizing existing legacy systems, service providers invested in reorienting themselves to rotate to digital, as well as gain domain expertise through in-house innovation, partnerships, and acquisitions.

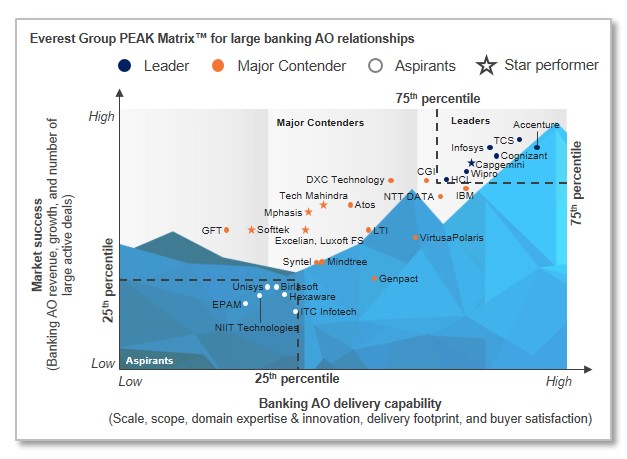

In this research, we analyze the current trends and the outlook for large, multi-year application outsourcing relationships in the global banking sector. We have assessed 28 banking AO service providers on their capabilities for providing these services globally. These providers were mapped on the Everest Group Performance | Experience | Ability | Knowledge (PEAK) Matrix, which is a composite index of a range of distinct metrics related to each provider’s capability and market success. In this report, we focus on:

- Assessment of service providers on capability-related dimensions

- Characteristics of Leaders, Major Contenders, and Aspirants on the Everest Group banking AO PEAK Matrix™

- “Star Performers” of 2017, providers with the strongest forward movement over time – in terms of both market success and capability advancements

- Implications for banking buyers and service providers

SCOPE OF THE ANALYSIS

- Market trends and activity for large AO relationships in banking firms

- Banking AO PEAK Matrix™ characteristics

- Banking AO service provider characteristics

CONTENT

This report analyzes IT applications outsourcing in the global banking subverticals with a focus on large (TCV > US$25 million), annuity-based, multi-year (over three years) relationships:

- Banking trends and its implications for key stakeholders

- Everest Group Performance Experience Ability Knowledge (PEAK) Matrix for banking AO

- Star Performers in the 2017 banking AO PEAK Matrix

- Banking AO PEAK Matrix characteristics:

- Market share and scale

- Scope characteristics

- Domain investments

- Delivery footprint

- Market activity

- Profiles of banking AO service providers

Everest Group has a complimentary four-page PEAK Matrix preview document for this service provider landscape report.

Membership(s)

Banking, Financial Services & Insurance (BFSI) - Information Technology Outsourcing (ITO)

Page Count: 102

|

Other Users Also Viewed

30 Nov 2016

Heightened customer expectations, stagnant growth, limited product differentiation, increasing threat from new entrants, and the stringent regulatory environment are the key challenges faced by insurers today. In addition to these industry headwinds,…

|