|

|

Open Banking IT Services PEAK Matrix® Assessment 2024

PEAK Matrix® Report

3 Jul 2024

by

Ronak Doshi, Pranati Dave, Apoorva A, Saumil Misra, Ayan Pandey

The open banking landscape is transforming due to regulatory mandates, technical advances, and dynamic consumer expectations. Financial institutions invest in open banking solutions to enhance customer experiences, foster innovation, and maintain a competitive edge. This transformation emphasizes the need for improved data security, regulatory compliance, and personalized financial services.

Providers offering API management, microservices architecture, data integration, and security frameworks lead this transformation. These solutions deliver seamless and secure customer experiences, drive innovation through FinTech partnerships, and create new revenue streams. Providers are building API-driven ecosystems to facilitate real-time connections with third parties, enhancing operational efficiencies and customer flexibility. As the open banking market matures, there is a growing emphasis on data monetization, leveraging advanced analytics for risk management and regulatory compliance, and exploring embedded finance opportunities.

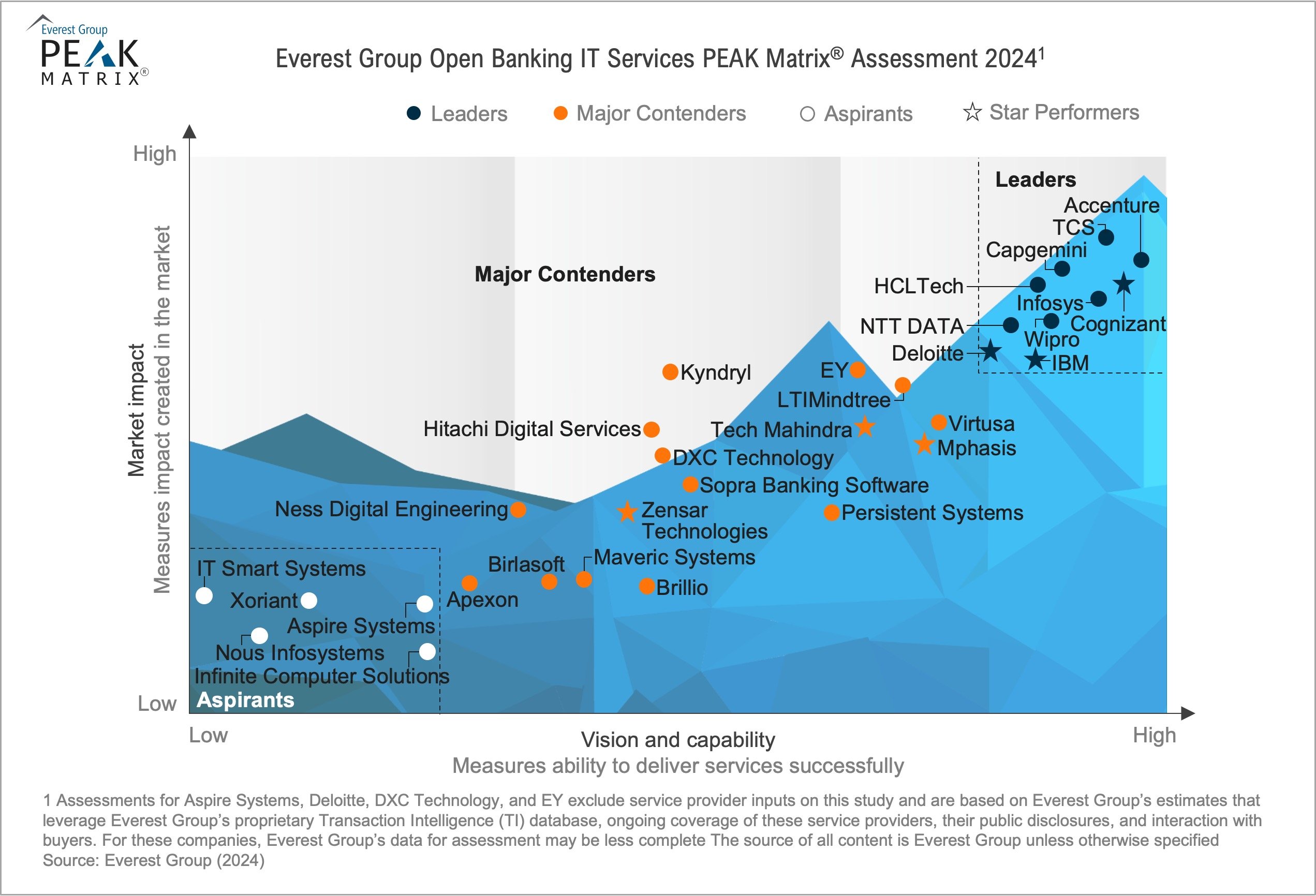

In this report, we analyze 31 open banking IT service providers featured on Everest Group’s proprietary PEAK Matrix® framework.

Scope

- Industry: Banking and Financial Services (BFS)

- Geography: global

- This assessment is based on Everest Group’s annual RFI process for the calendar year 2024, interactions with leading technology and IT service providers, client reference checks, and an ongoing analysis of the open banking IT services market

Contents

In this report, we:

- Examine key trends in the open banking IT services industry

- Position the providers on Everest Group’s proprietary PEAK Matrix® framework as Leaders, Major Contenders, and Aspirants

- Compare providers’ key strengths and limitations

Membership(s)

Banking Information Technology

Sourcing and Vendor Management

Page Count: 72

|

Other Users Also Viewed

PEAK Matrix® Report

24 Aug 2022

Global macroeconomic conditions indicate the rising probability of a recession. Despite the resulting cost pressures, enterprise demand for D&A services is rising as enterprises realize that data-driven solutions focused on cost optimization and comp…

|