The insurance industry faces headwinds such as obsolete legacy systems, talent shortages, and resistance to change. In addition, consumer needs, habits, and expectations, which were evolving gradually before COVID-19, have radically shifted during the pandemic, spurred by the demand for compelling online experiences. To deal with these challenges, insurer preferences are shifting from building customized solutions to buying off-the-shelf products and rapidly adopting third-party core platforms such as Duck Creek to reduce latency, improve efficiency, drive product innovation, and build a modern core to power superior front-office experiences.

Duck Creek has led the modernization story for the Property & Casualty (P&C) insurance industry by aggressively pushing its SaaS-based Duck Creek OnDemand (DCOD) offering, characterized by low-code configurability, ease of deployment, rapid time-to-market, and a wide partnership ecosystem, to enable digital transformation for carriers. IT service providers are investing heavily to enhance their capabilities across core Duck Creek products. They are also looking to expand beyond core modules and invest in training for Duck Creek OnDemand (DCOD) implementations and non-core modules such as insights, digital engagement, and distribution management modules.

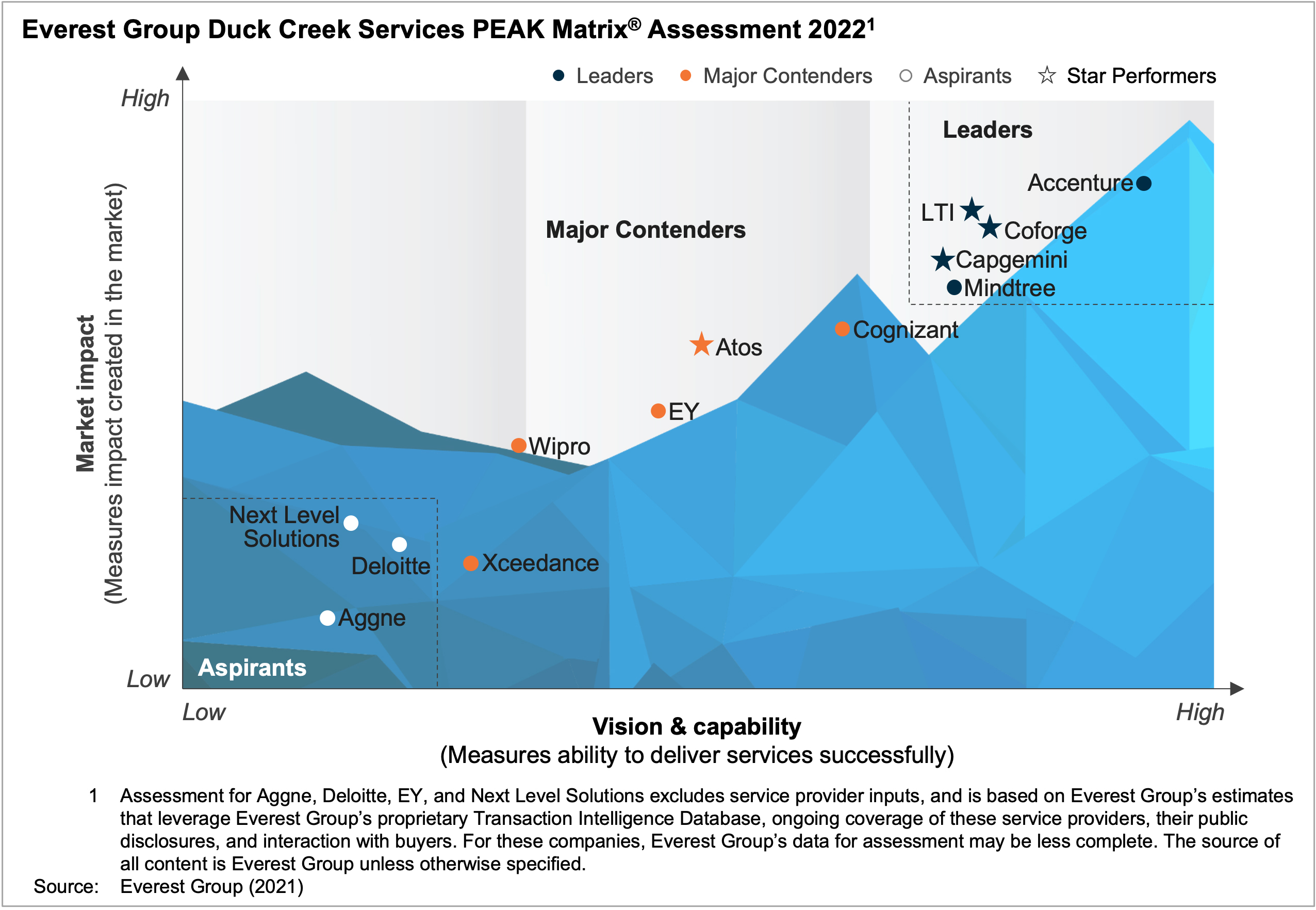

This report examines the Duck Creek services landscape and presents a detailed assessment of 13 leading providers featured on Everest Group’s Duck Creek Services PEAK Matrix® Assessment 2022.

Scope

Industry: insurance, financial services

Geography: global

Contents

In this report, we share:

- An assessment of 13 leading Duck Creek service providers on Everest Group’s Services PEAK Matrix®

evaluation framework

- Characteristics of Leaders, Major Contenders, and Aspirants in the Duck Creek services market

- Detailed profiles of the providers, along with their key strengths and limitations

Membership(s)

Insurance Information Technology

Sourcing and Vendor Management