|

|

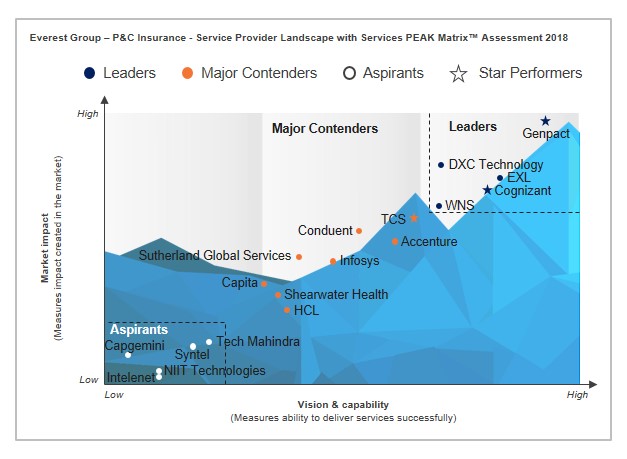

Property and Casualty (P&C) Insurance BPO – Service Provider Landscape with Services PEAK Matrix™ Assessment 2018

29 Mar 2018

by

Somya Bhadola

The global P&C insurance BPO market continued to be dynamic, witnessing considerable activity in acquisitions/partnerships and substantial expansion in 2016-2017. While a number of P&C insurers signed new contracts driving the adoption up, expansion of scope of services offered by the service providers was the key driver of over 25% market growth.

North America and the United Kingdom continued to be the primary P&C insurance BPO markets, together accounting for over 85% of the market by revenue. Other geographies, especially Asia Pacific, also witnessed an increase in contractual activity.

While the first generation of outsourcing enterprises focused on leveraging labor arbitrage and accessing technology solutions, the second and the third generation of buyers are demanding value addition from service providers beyond the labor arbitrage. Such buyers are now demanding assistance in strengthening their market presence and enhancing their customer centricity.

Service providers have started aligning their value-propositions with the market demand. A number of them are now offering end-to-end solutions including assistance on some of the judgment-intensive and core-insurance processes. While almost every leading service provider has automation and analytics solutions, some of them have developed a robust suite of solutions for digital transformation.

Scope and Methodology

In this research, we analyze the global P&C insurance BPO service provider landscape. We focus on:

- Relative positioning of 18 service providers on Everest Group’s PEAK Matrix for P&C insurance BPO

- Service provider market success

- Service provider capability assessment across key dimensions

- Comments about service providers

Content

This report examines the global P&C insurance BPO market and its service provider landscape. It provides detailed analysis of the capabilities and market performance of service providers and their relative position on the Everest Group PEAK Matrix. It will assist key stakeholders (insurance providers, service providers, and technology providers) understand the current state of the P&C insurance BPO service provider landscape.

- P&C insurance BPO PEAK Matrix 2018 positioning is as follows:

- Leaders: Cognizant, DXC, EXL, Genpact, and WNS

- Major Contenders: Accenture, Capita, Conduent, HCL, Infosys, Shearwater Health, Sutherland Global Services, and Tata Consultancy Services

- Aspirants: Capgemini, Intelenet, NIIT Technologies, Syntel, and Tech Mahindra

- Cognizant, Genpact, and TCS are the “Star Performers” on the P&C insurance BPO Everest Group PEAK Matrix for 2018

- Market share assessment of 18 service providers by

- Revenue

- Revenue growth

- Geography (signing region)

- Buyer size

- Everest Group’s assessment for 18 service providers

Everest Group has a complimentary five-page PEAK Matrix preview document for this service provider landscape report.

Membership(s)

Insurance - Business Process Outsourcing (BPO)

Page Count: 52

|

Other Users Also Viewed

Provider Snapshot

26 May 2023

This Snapshot is available only to Outsourcing Excellence and CX Excellence members. For information on membership, please contact us

The global services market is highly dynamic and evolving at a rapid pace. This is reflected in the shift in prio…

|