The life sciences market experienced significant turbulence in 2017 as a result of a variety of factors, including escalating costs, widespread regulatory amendments,

changing business models, and the evolution of the patient-centric paradigm (with mobile computing, social media platforms, “anytime-anywhere” information access,

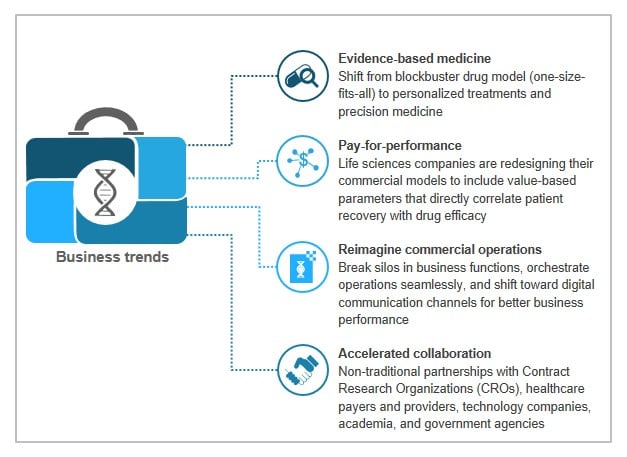

and self-service channels). These factors drove the market toward never-before-explored frontiers such as evidence-based medicine and pay-for-performance.

Additionally, pressure to reduce costs pushed pharma companies toward centralization and collaboration to share R&D costs.

In 2018, pay-for-performance and evidence-based medicine drivers will gain momentum with more and more pharma companies investing in these areas.

On top of that, we will see an increased need for a supply chain overhaul to support the complex logistics requirement for personalized medicine

and support the regulatory push from authorities for transparency.

This report talks about key themes that dominated the life sciences market in 2017. It also discusses enterprise actions and central sourcing themes.

The report lists top 15 life sciences service providers based on four life sciences PEAK Matrix™ BP and IT services evaluations done in 2017 and gives

a brief description of 2018 market outlook.

This report is structured across four key sections:

- Key themes that dominated the life sciences market in 2017

- Key enterprise actions and central sourcing themes

- Ranking of top 15 life sciences service providers based on five healthcare PEAK Matrix™ BP and IT services evaluations done in 2017

- Market outlook for 2018

37 outsourcing service providers who participated in four life sciences PEAK Matrix™ BP and IT services evaluations in 2017 are covered in this report.

Membership(s)

Healthcare Payer and Provider Business Process

Life Sciences Business Process

Healthcare & Life Sciences IT Outsourcing