|

|

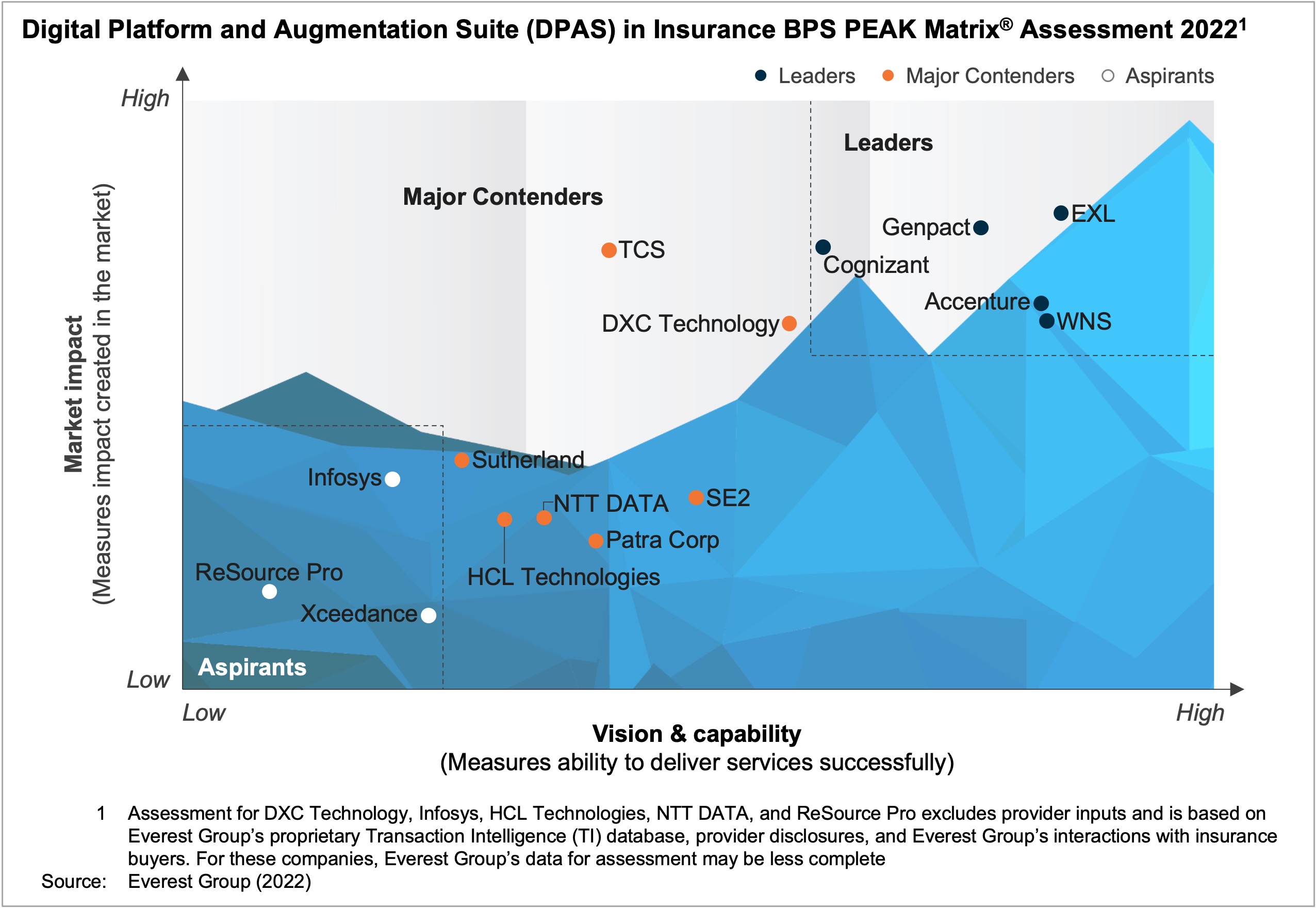

Digital Platform and Augmentation Suite (DPAS) in Insurance BPS – Provider Landscape with Services PEAK Matrix® Assessment 2022

PEAK Matrix® Report

27 Sep 2022

by

Manu Aggarwal, Abhimanyu Awasthi, Dinesh Udawat

As insurance BPS industry shifts from arbitrage-first to digital model, insurers increasingly seek to understand digital capabilities of service providers. Disruptions in customer preferences and insurers’ growing needs to move faster have led to a significant change in the sourcing strategy as well. In order to pivot operations in such times, digital solutions offered by BPS providers helped in enhancing speed of delivery, reducing turn-around times, improving accuracy, and the quality of products. Such transformation projects helped in simplifying the insurance process by optimizing support functions across the value chain.

In this research, we assess 15 insurance BPS providers featured on the DPAS in Insurance BPS PEAK Matrix&®. Each provider profile offers details of the provider’s service focus, key Intellectual Property (IP) / solutions, domain investments, and case studies.

Scope

- Industry: industry-specific insurance BPS, including both P&C and L&P line of businesses

- In this report, we cover the vertical-specific insurance BPS market. We do not cover horizontal business processes, such as Finance and Accounting (F&A), Human Resources (HR), procurement, and contact center

- Geography: global

- The assessment is based on Everest Group’s annual RFI process for the calendar year 2022, interactions with leading insurance BPS providers, client reference checks, and an ongoing analysis of the insurance BPS market

Contents

This report evaluates:

- The relative positioning of 15 providers on Everest Group’s PEAK Matrix® for DPAS in insurance operations

- Providers’ market impact

- Providers’ vision and capabilities across key dimensions

Membership(s)

Insurance Business Process

Sourcing and Vendor Management

Page Count: 45

|

Other Users Also Viewed

PEAK Matrix® Report

8 Apr 2022

With the Property & Casualty (P&C) insurance industry emerging from the global pandemic and volumes reaching pre-COVID-19 levels, the P&C insurance Business Process Service (BPS) market achieved one of its highest growth rates in 2021. Factors such…

|