|

|

US Contingent Workforce (Staffing) Provider PEAK Matrix® Assessment 2021 – Going Beyond Scale

PEAK Matrix® Report

30 Jun 2021

by

Priyanka Mitra, Arkadev Basak

The US contingent workforce (staffing) industry experienced a sustained growth momentum up to 2019. In 2020, the COVID-19 pandemic disrupted the industry, with the use of contingent staffing plummeting across the country. Despite the fall, service providers showed resilience and used the adversity as an opportunity to focus on improvements such as remote delivery of services, learning and upskilling, and new technologies.

In this research, we analyze the US contingent workforce (staffing) provider landscape across various dimensions, with focus on:

- The US contingent workforce (staffing) provider landscape overview

- US Contingent Workforce (Staffing) Provider PEAK Matrix®Assessment

- Service provider delivery capability assessment

Scope

Industry: contingent workforce (staffing)

Geography: US

Contents

The report analyzes the performance of various contingent workforce (staffing) providers and studies:

- The US contingent workforce (staffing) provider landscape

- US Contingent Workforce (Staffing) Provider PEAK Matrix® Assessment

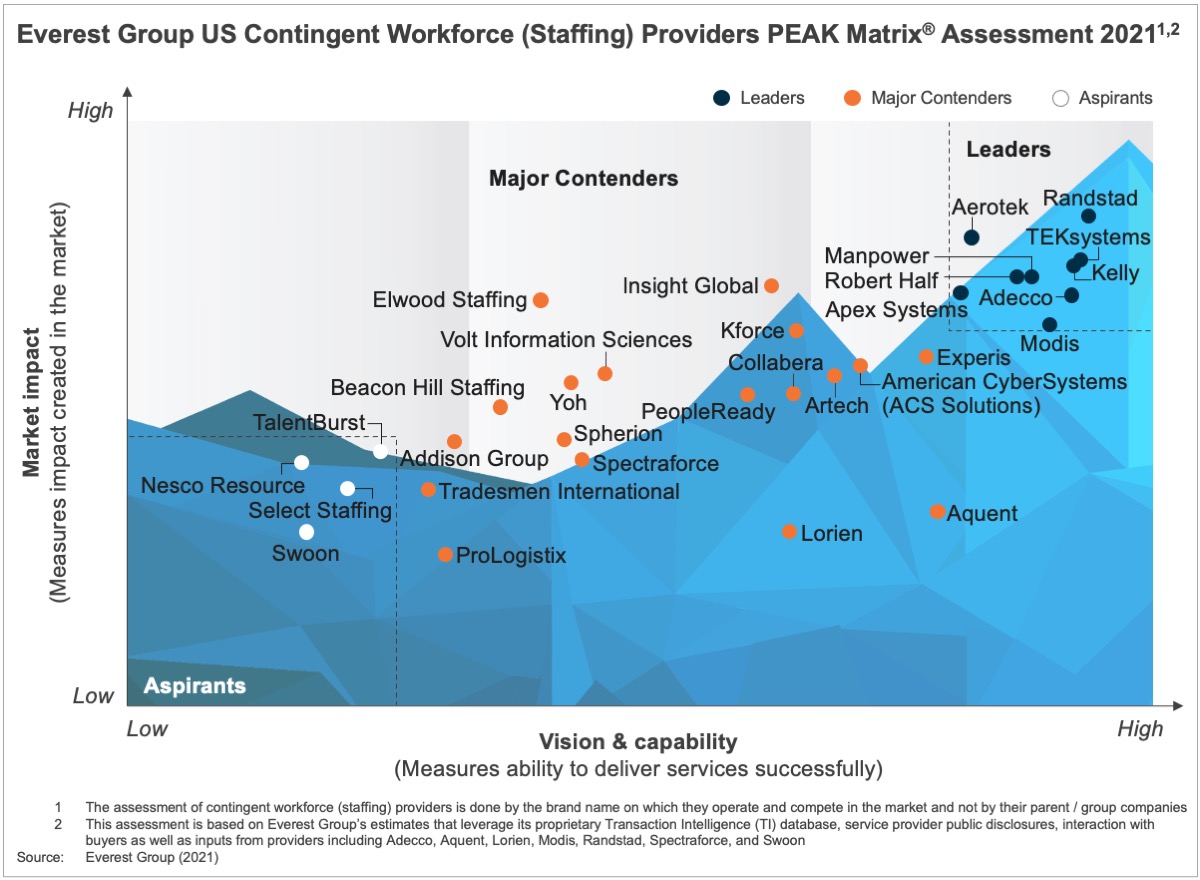

- Classification of 31 US contingent workforce (staffing) providers into Leaders, Major Contenders, and Aspirants on Everest Group’s proprietary PEAK Matrix® framework

- Everest Group analysis of service providers

- We assess the overall US contingent workforce (staffing) capability of service providers by evaluating them along seven dimensions: market adoption, portfolio mix, value delivered, scope of services offered, innovation & investments, delivery footprint, and vision & strategy

Membership(s)

Contingent Workforce Management

Sourcing and Vendor Management

Page Count: 69

|

Other Users Also Viewed

PEAK Matrix® Report

22 Jul 2022

While the US contingent staffing industry sustained its growth momentum through 2019, the COVID-19 pandemic disrupted the industry in 2020, and the use of contingent staffing plummeted across the country. In 2021, talent demand surged due to a rapid…

|