|

|

US Contingent Talent and Strategic Solutions PEAK Matrix® Assessment 2023

PEAK Matrix® Report

20 Jul 2023

by

Priyanka Mitra, Varun Malik, Dileep Amanchi, Amit Anand, Shreya Chawla, Akshit Tomar

After the COVID-19 pandemic, the demand for contingent talent surged, leading to continued growth in the US contingent talent and strategic solutions industry throughout 2022. The scarcity of skilled workers drove this growth, as enterprises faced ongoing challenges in acquiring talent due to both a skills shortage and voluntary employee turnover. Despite concerns about an impending recession, the talent supply and demand imbalance persisted, resulting in a prolonged talent shortage in the US. This situation created an opportunity for providers of contingent talent and strategic solutions to address the talent gap by investing in various areas, including technology-driven solutions, managed services, learning and upskilling programs, and fostering DEI.

This report analyzes the intricate dynamics of the US contingent talent and strategic solutions provider landscape and its impact on the overall US contingent talent and strategic solutions market in 2022. It specifically focuses on IT staffing, engineering staffing, business and professionals staffing, and industrial staffing. The report provides a comprehensive overview of the market and examines how providers differentiate themselves using the extensive Everest Group PEAK Matrix® as a benchmark for analysis.

Scope

- Industry: contingent talent and strategic solutions

- Geography: US

- Skills coverage: IT, engineering, business and professionals, and industrial

Contents

The report analyzes the performance of various contingent talent and strategic solutions providers and examines:

- The US contingent talent and strategic solutions provider landscape

- US Contingent Staffing Provider PEAK Matrix® Assessment:

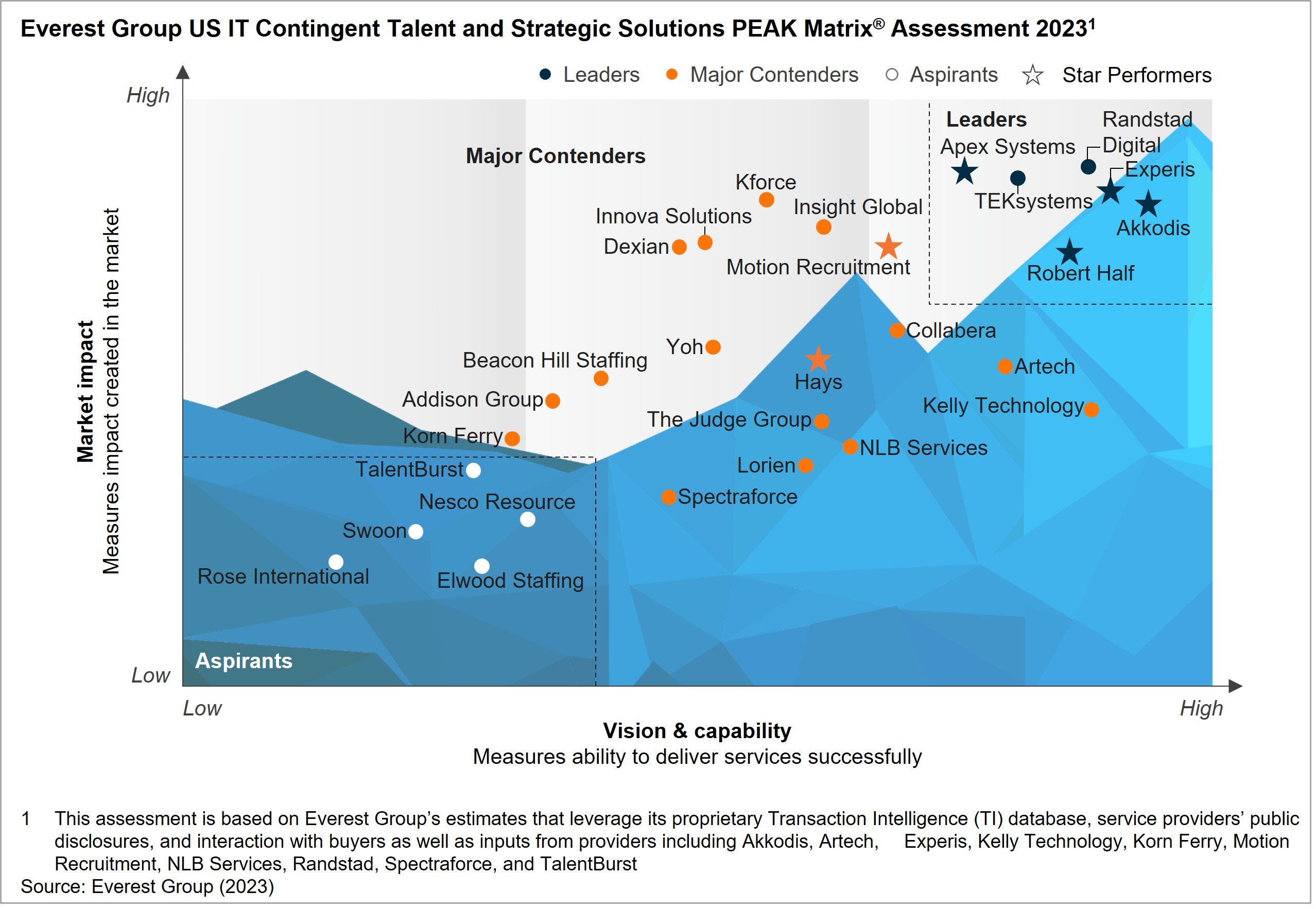

- Classification of 28 US IT contingent talent and strategic solutions providers into Leaders, Major Contenders, and Aspirants on Everest Group’s proprietary PEAK Matrix® framework

- Classification of 22 US engineering contingent talent and strategic solutions providers into Leaders, Major Contenders, and Aspirants on Everest Group’s proprietary PEAK Matrix® framework

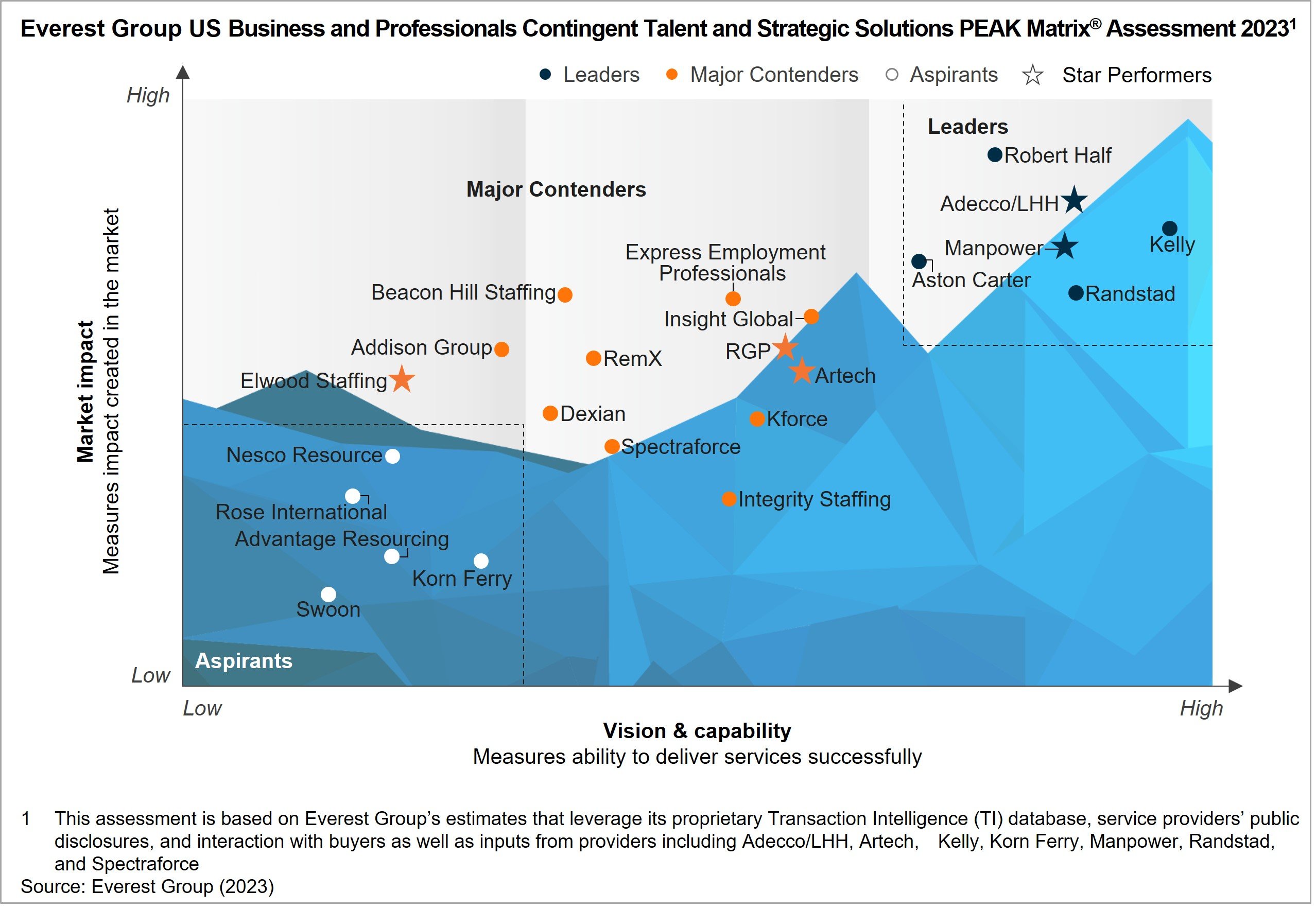

- Classification of 23 US business and professionals contingent talent and strategic solutions providers into Leaders, Major Contenders, and Aspirants on Everest Group’s proprietary PEAK Matrix® framework

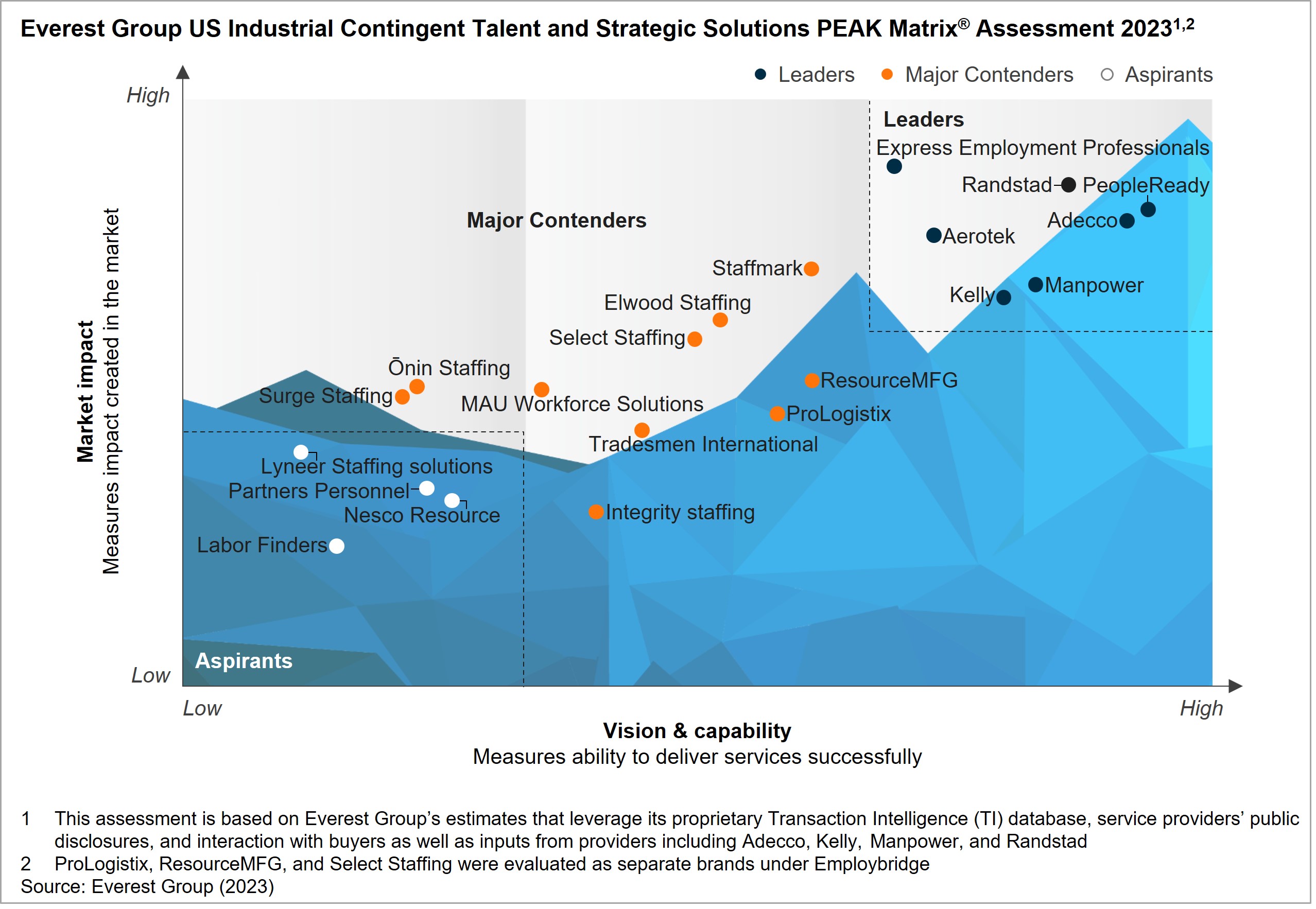

- Classification of 21 US industrial contingent talent and strategic solutions providers into Leaders, Major Contenders, and Aspirants on Everest Group’s proprietary PEAK Matrix® framework

- Everest Group analysis of providers:

- US contingent talent and strategic solutions providers’ capability assessment on seven dimensions: market adoption, portfolio mix, value delivered, scope of services offered, innovation and investments, delivery footprints, and vision and strategy

- Remarks on key strengths and limitations of each contingent talent and strategic solutions provider

Membership(s)

Contingent Staffing

Sourcing and Vendor Management

Page Count: 177

|

Other Users Also Viewed

PEAK Matrix® Report

17 Aug 2023

In the next normal, due to enterprises’ increased focus on workforce scalability and agility, the contingent workforce is emerging as a key focus area. As a result, enterprises are increasingly leveraging Contingent Workforce Management (CWM) / Manag…

|