With the Property & Casualty (P&C) insurance industry emerging from the global pandemic and volumes reaching pre-COVID-19 levels, the P&C insurance Business Process Service (BPS) market achieved one of its highest growth rates in 2021. Factors such as increasing cost pressures, the ongoing talent war, and higher attrition in the insurance industry assisted this growth. Recognizing an opportunity, providers are focusing on capability enhancements – both technical and digital – to provide new service delivery processes across the value chain.

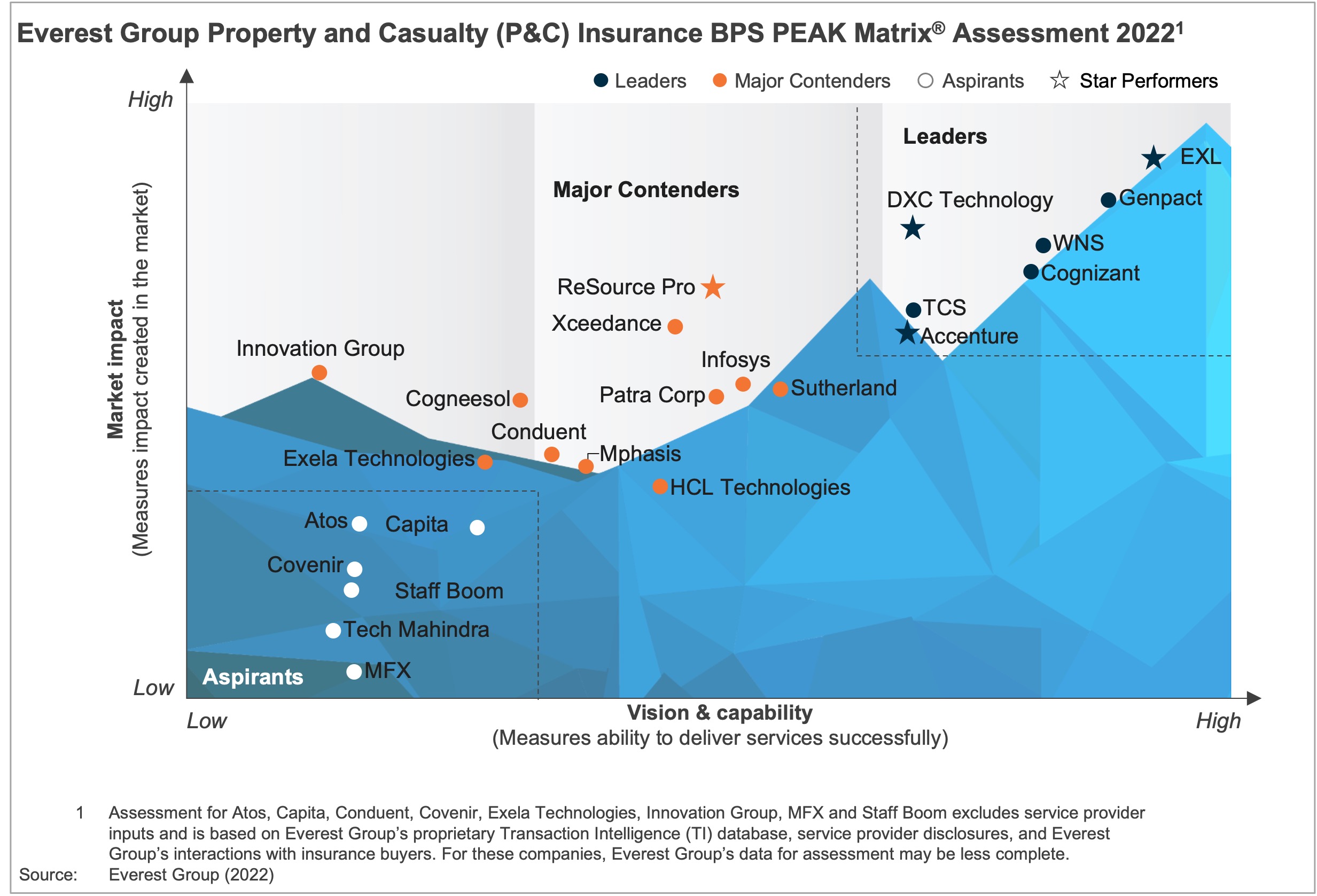

In this research, we assess 24 P&C Insurance BPS providers featured on the P&C Insurance BPS PEAK Matrix®. Each provider profile offers details of the provider’s service focus, key Intellectual Property (IP) / solutions, domain investments, and case studies.

Scope

In this report, we cover the vertical-specific P&C insurance BPS market. We do not cover horizontal business processes, such as Finance and Accounting (F&A), Human Resources (HR), procurement, and contact center

Industry: industry-specific P&C insurance BPS, including personal, commercial, and specialty lines

Geography: global

The assessment is based on Everest Group’s annual RFI process for the calendar year 2022, interactions with leading P&C Insurance BPS providers, client reference checks, and an ongoing analysis of the P&C Insurance BPS market

Contents

This report evaluates:

- The relative positioning of 24 providers on Everest Group’s PEAK Matrix® for P&C Insurance BPS

- Provider market impact

- Providers’ vision and capabilities across key dimensions

Membership(s)

Insurance Business Process

Sourcing and Vendor Management