|

|

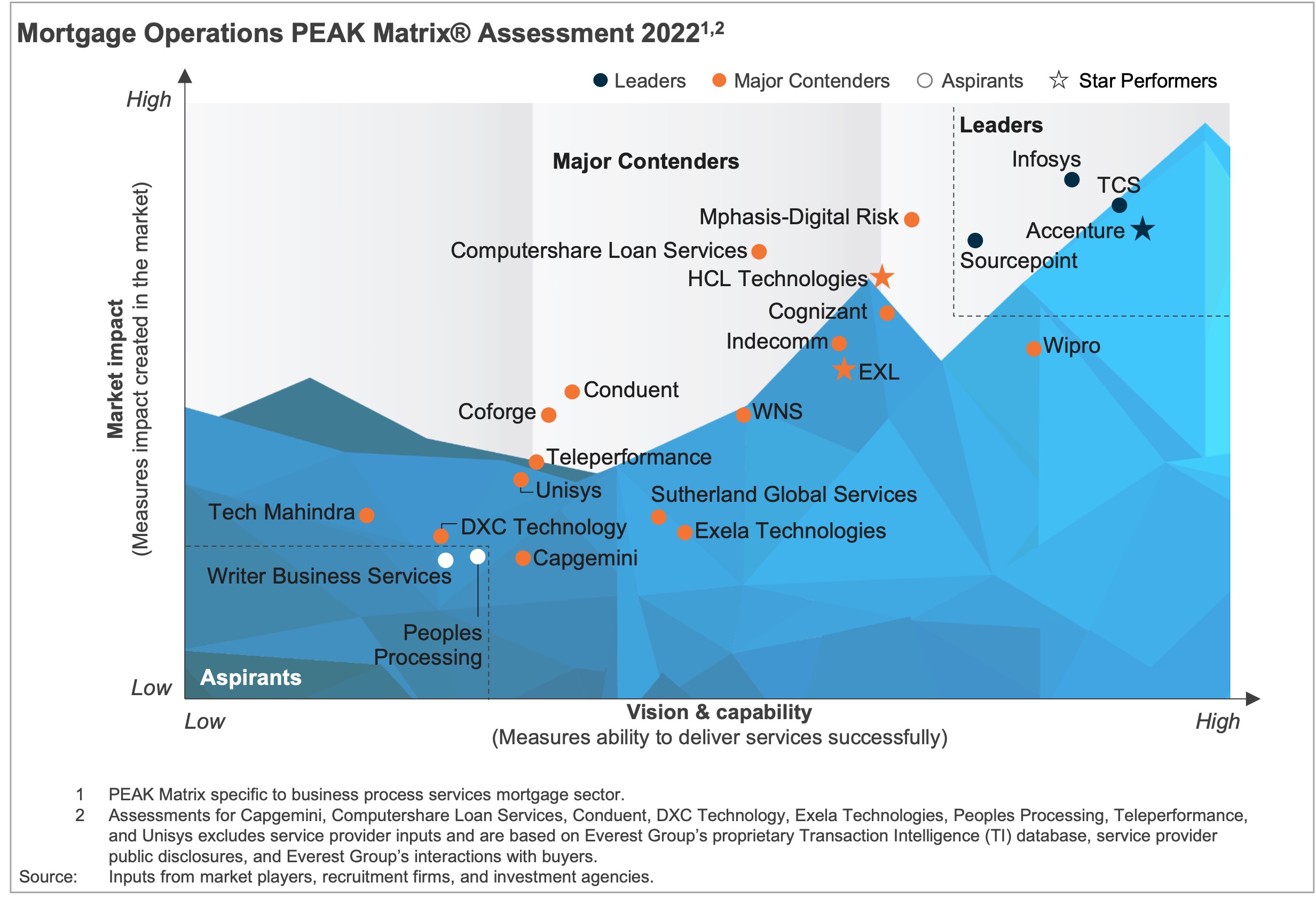

Mortgage Operations PEAK Matrix® Assessment 2022

PEAK Matrix® Report

7 Feb 2022

by

Manu Aggarwal, Abhilasha Sharma, Shrey Jain

As lenders seek solutions to improve their capabilities, adapt to consumer expectations, and gain market share, the mortgage operations landscape is becoming more competitive and dynamic.

Following the pandemic, the sector experienced low interest rates and high demand for much of 2021, but the tide has turned, and interest rates are rising again. The pandemic has also significantly changed consumer demand patterns, mortgage stakeholder working styles, and service delivery approaches. Consumer demand patterns have shifted toward younger and more digital-savvy borrowers, who value experience and convenience over cost. Providers are actively leveraging the partner ecosystem and new acquisitions to augment their capabilities and improve their offerings’ time-to-market. They have invested in and built digital lending solutions and tools that assist in the entire loan life cycle and enhance customer experience.

On the market side, the mortgage securitization market has been marked by high competition among providers across other major lines of business, while on the buyer side, there has been an increase in mortgage originations. North America continues to dominate market share in terms of size and new transactions, while providers are gaining a better understanding of demand patterns in Asia Pacific, the United Kingdom, and Continental Europe. Non-bank buyers, such as FinTechs, and real estate businesses, have been demand sources for service providers.

This report provides a detailed analysis of the vision, delivery capabilities, and market successes of 23 mortgage operations service providers and their relative position on the Everest Group PEAK Matrix® for Mortgage Operations. The study will assist key stakeholders, such as banks, financial institutions, service providers, and technology providers, in understanding the current state of the mortgage operations service provider market.

Scope

- In this report, we study vertical-specific mortgage operations. We have not covered horizontal business processes such as Finance and Accounting (F&A), Human Resources (HR), procurement, and contact center

- Industry: banking and financial services

- Geography: global

Contents

This report features profiles of 23 mortgage operations service providers, each of which includes:

- Relative positioning of the providers on Everest Group’s PEAK Matrix® for Mortgage Operations

- Provider market impact analysis

- Provider vision and capability assessment across key dimensions

- Enterprise sourcing considerations

Membership(s)

Banking and Financial Services Business Process

Sourcing and Vendor Management

Page Count: 57

|

Other Users Also Viewed

27 Mar 2020

As more and more millennials become clients of wealth managers, it becomes imperative for the latter to overhaul traditional methods of managing wealth. In this regard, they are currently building and increasing their online presence, digitally onboa…

|