|

|

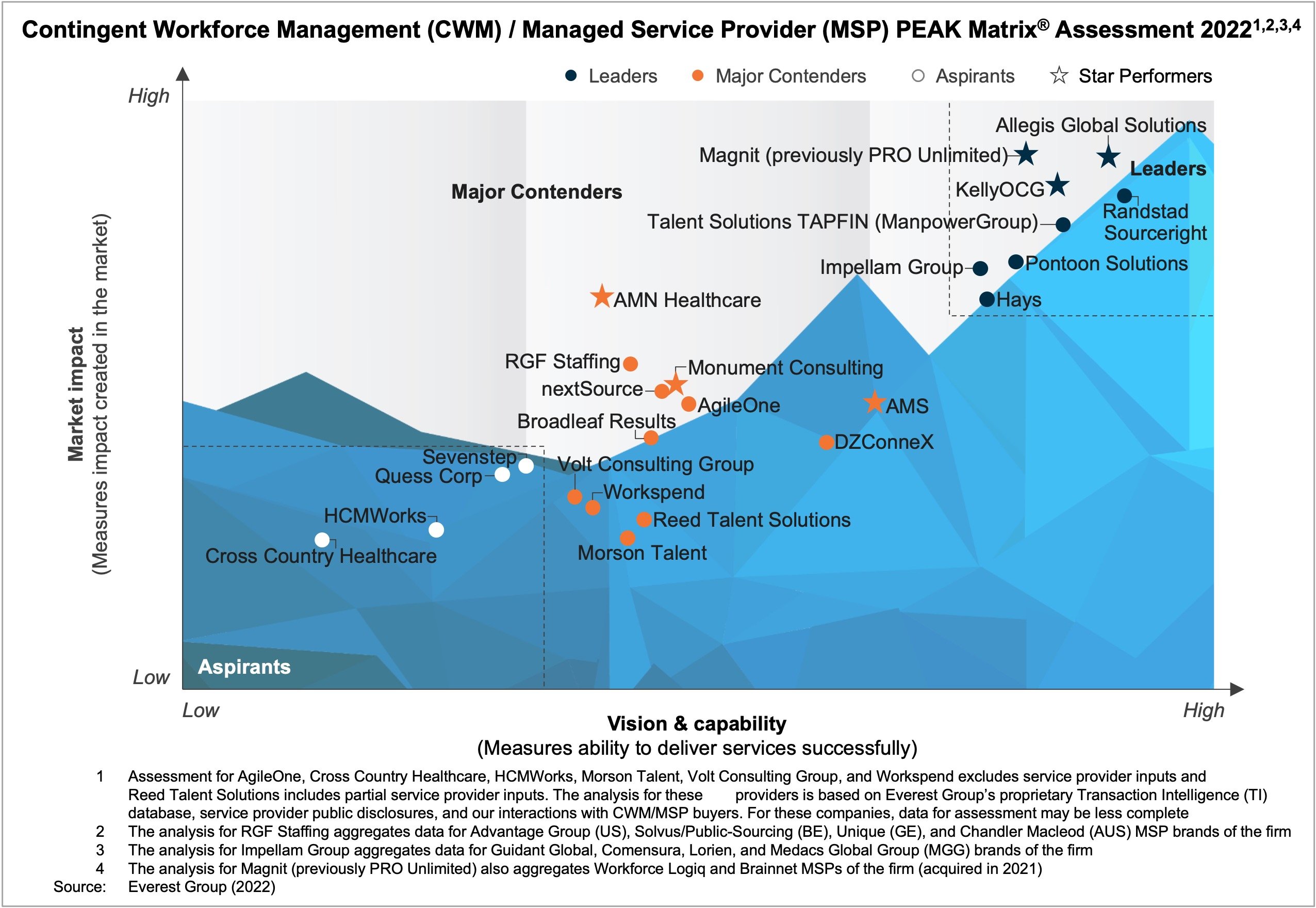

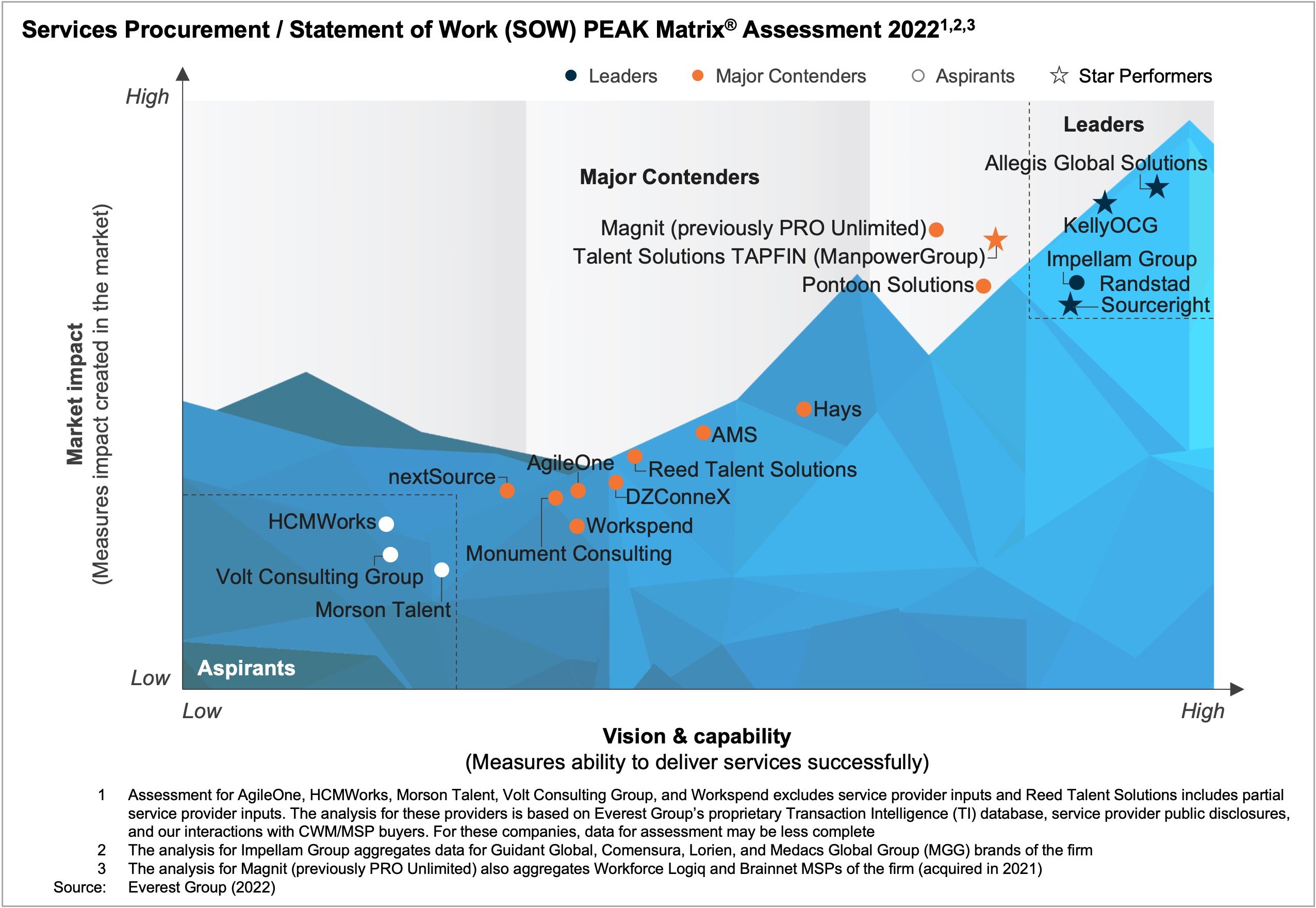

Contingent Workforce Management (CWM) / Managed Service Provider (MSP) and Services Procurement / Statement of Work (SOW) PEAK Matrix® Assessments 2022

PEAK Matrix® Report

31 Aug 2022

by

Krishna Charan, Soumya Bansal, Rhea Nijhawan, Akash Shukla, Jaskaran Singh

The global Contingent Workforce Management (CWM) market is rapidly growing and transforming as buyers demand more services from providers. In addition to employing traditional temporary labor, buyers are relying on third-party providers to manage additional labor categories, including services procurement / Statement of Work (SOW), Independent Contractors (ICs), and permanent labor. Temporary labor still constitutes a major proportion of the spend that Managed Service Providers (MSPs) handle, though services procurement has also garnered a significant share, which continues to grow steadily.

In response to these market developments, service providers are increasing the breadth and depth of their offerings and making investments to manage all types of contingent workers, enhance the scope of their services, ensure process digitization, and expand their consulting capabilities.

This PEAK Matrix® assessment will help key stakeholders – buyers, service providers, and technology providers – understand the MSP / CWM service provider and services procurement provider landscape, evaluate service providers’ capabilities, and identify the Leaders, Major Contenders, and Aspirants in the market.

Scope

- Over 1,700 CWM/MSP and services procurement deals

- Coverage across 24 MSPs / CWM service providers: AgileOne, Allegis Global Solutions, AMN Healthcare, AMS, Broadleaf Results, Cross Country Healthcare, DZConneX, Hays Talent Solutions, HCMWorks, Impellam Group, KellyOCG, Monument Consulting, Morson Talent, nextSource, Pontoon Solutions, Magnit, Quess Corp, Randstad Sourceright, Reed Talent Solutions, RGF Staffing, Sevenstep, Talent Solutions TAPFIN Manpower Group, Volt Consulting Group, and Workspend

- Coverage across 18 services procurement service providers: AgileOne, Allegis Global Solutions, AMS, DZConneX, Hays Talent Solutions, HCMWorks, Impellam Group, KellyOCG, Monument Consulting, Morson Talent, nextSource, Pontoon Solutions, PRO Unlimited, Randstad Sourceright, Reed Talent Consulting, Talent Solutions TAPFIN Manpower Group, Volt Consulting Group, and Workspend

Industry: all industries

Geography: global

Contents

The report analyzes the performance of 24 MSPs / CWM service providers and 18 services procurement service providers. It features:

- The MSP / CWM service provider landscape

- The services procurement service provider landscape

- MSP / CWM service provider PEAK Matrix® and Star Performers for 2022

- Classification of service providers into Leaders, Major Contenders, and Aspirants on Everest Group’s proprietary PEAK Matrix® framework

- Services procurement / SoW PEAK Matrix® and Star Performers for 2022

- Classification of service providers into Leaders, Major Contenders, and Aspirants on Everest Group’s proprietary PEAK Matrix® framework

- Everest Group analysis of service providers:

- Overall CWM/MSP and services procurement capability assessed by evaluating the service providers along seven dimensions – market adoption, portfolio mix, value delivered, scope of services offered, innovation & investments, delivery footprint, and vision & strategy

Membership(s)

Contingent Workforce Management

Sourcing and Vendor Management

Page Count: 96

|

Other Users Also Viewed

State of the Market Report

13 Dec 2022

In the next normal, contingent workforce is emerging as a key focus area for enterprises. As a result, enterprises are increasingly leveraging Contingent Workforce Management (CWM) / Managed Service Providers (MSPs) and Vendor Management Systems (VMS…

|