The APAC Customer Experience Management (CXM) market remained strongly resilient after the pandemic in 2021. Digitization and digital transactions increased in developing countries, such as India, China, Malaysia, and Indonesia. Buyer demographics in APAC are skewed toward small and midsize enterprises, which require a combination of digital tools, such as advanced analytics, intelligent automation, conversational AI, omnichannel, and agent-assist tools, to serve the surging demand for personalization across industries. These enterprises are increasingly turning to service providers and leveraging their domain and technical expertise to scale and digitalize their operations.

Also noticeable is a strong demand for transformation consulting services, such as customer journey mapping and design thinking among enterprises to accelerate their digital transformation initiatives and ensure business continuity, leading to a scope expansion within existing CXM contracts.

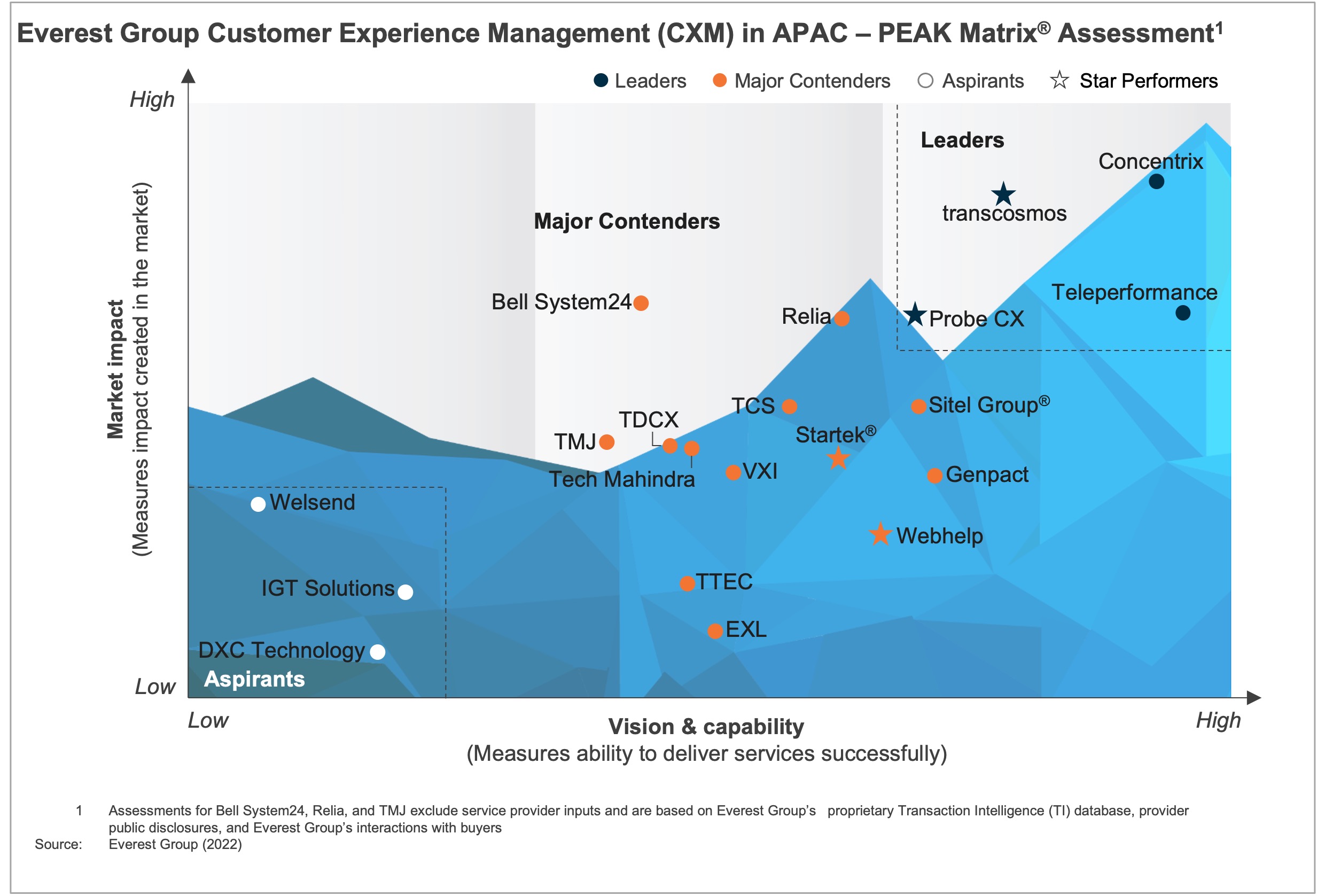

In this research, we present detailed assessments of 20 CXM service providers in APAC featured on the CXM Services PEAK Matrix® Assessment 2022. Each assessment provides a comprehensive picture of the service provider’s market success, vision and strategy, service focus and capabilities, digital and technological solutions, domain investments, and buyer feedback.

Scope

- Geography: Asia Pacific

- The assessment is based on Everest Group’s annual RFI process for the calendar year 2022, interactions with leading CXM service providers, client reference checks, and an ongoing analysis of the CXM services market

Contents

This report examines:

- CXM in APAC – Service Provider Landscape with PEAK Matrix® Assessment 2022

- Strengths and limitations of the service providers studied

- Sourcing considerations for buyers

Membership(s)

Customer Experience Management (CXM) Services, including Contact Center Outsourcing

Sourcing and Vendor Management