|

|

Consumer Loan Origination Systems – Products PEAK Matrix® Assessment 2022

PEAK Matrix® Report

10 Dec 2021

by

Ronak Doshi, Aaditya Jain, Pranati Dave, Kriti Gupta, Saumil Misra

The consumer lending industry has seen massive shifts in the past decade due to technology advances and ever-changing customer expectations. Internet and smart phone penetration has forced banks and financial institutions to shift from a traditional to a digital lending culture, with increasing emphasis on reducing the loan processing time. Emerging from the pandemic, governments worldwide have reduced interest rates and are providing stimulus to individuals through massive lending programs. Additionally, the rise of challenger and neo-banks has forced banks and traditional lenders to rethink their technology adoption strategies. There is an increasing need for transforming lending systems to keep up with the pace of change. Banking and financial institutions are relying on digital lending platforms to modernize their processes, reduce operational costs, and improve customer experience.

The technology provider landscape for consumer loan origination is vibrant, with a mix of traditional and next-generation providers. Through investments in unified platforms that cater to multiple lending products and leverage next-generation technologies, these providers are supporting lenders in their digital transformation journeys for consumer lending.

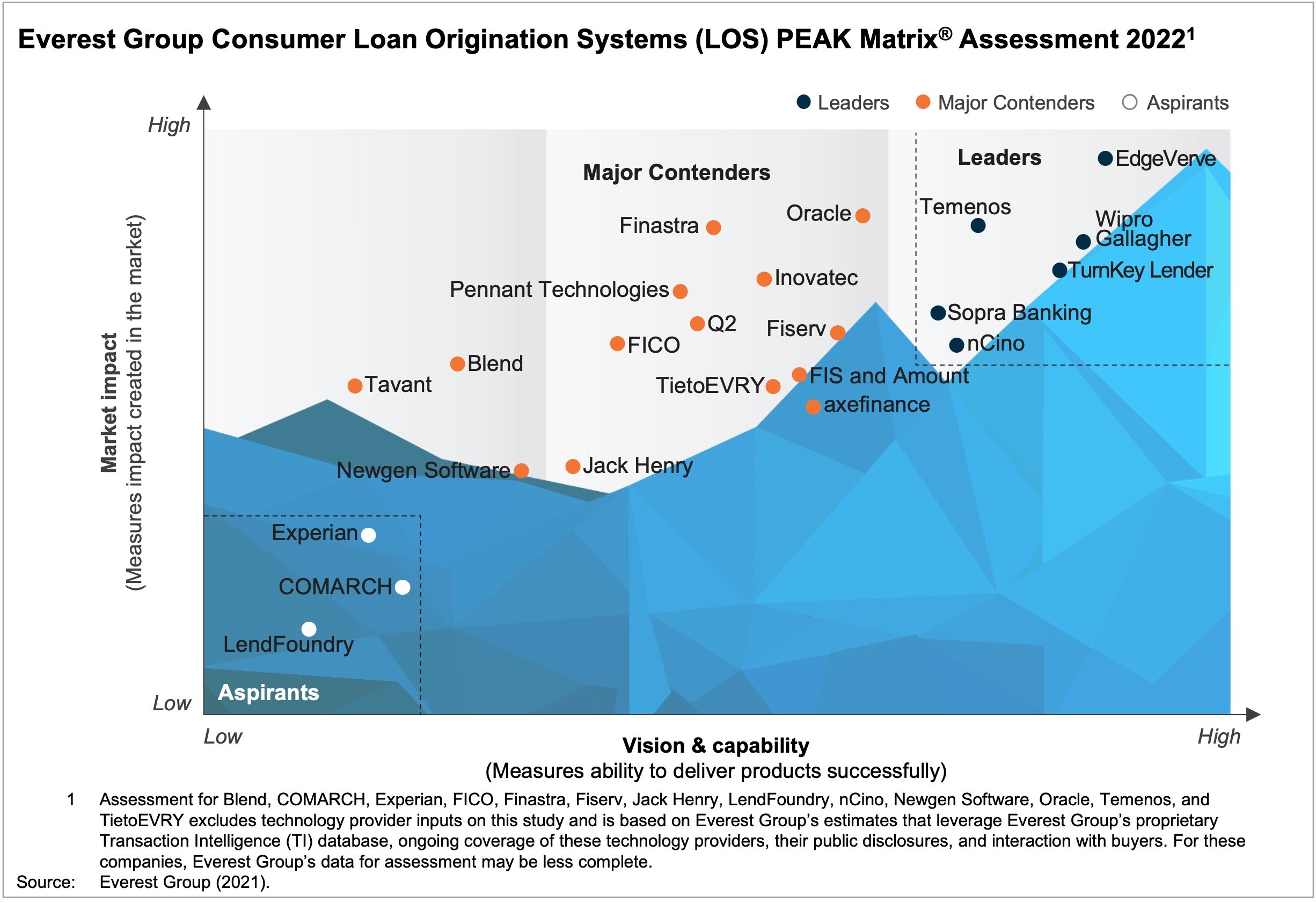

In this report, we assess 23 technology providers in terms of their consumer Loan Origination Systems (LOS) products’ vision and capability and market impact and categorize them as Leaders, Major Contenders, and Aspirants. The research will help buyers select the right-fit technology provider for their needs, while technology providers will be able to benchmark themselves against each other.

Scope:

Industry: banking

Geography: global

Our assessment is based on Everest Group’s annual RFI process for the calendar year 2021, interactions with leading application and digital services providers, client reference checks, and an ongoing analysis of the consumer LOS market.

Contents:

In this report, we:

- Classify 23 consumer LOS technology providers as Leaders, Major Contenders, and Aspirants, and map them on Everest Group’s proprietary PEAK Matrix® framework

- Examine the competitive landscape of the consumer LOS technology provider market

- Evaluate the key enterprise sourcing considerations (strengths and limitations) for each of the 23 technology providers evaluated

Membership(s)

Banking Information Technology

Sourcing and Vendor Management

Page Count: 60

|

Other Users Also Viewed

Provider Compendium Report

28 Jan 2022

The consumer lending industry has seen massive shifts in the past decade due to technology advances and ever-changing customer expectations. Internet and smart phone penetration has forced banks and financial institutions to shift from a traditional…

|