|

|

Open Finance IT Services PEAK Matrix® Assessment 2023

PEAK Matrix® Report

9 Dec 2022

by

Ronak Doshi, Pranati Dave, Kriti Gupta, Apoorva A, Saumil Misra, Keshav R, Kriti Seth

The concept of open banking is no longer restricted to payment services. Open finance has widened its scope to include mortgages, wealth management, insurance, savings, and capital markets. These use cases are giving rise to concepts such as embedded finance, buy now pay later, and super-apps, which will allow banks to deliver hyper-personalized products and become more customer-centric. Open finance can disrupt traditional banking models and give rise to innovative models such as marketplace banking.

Additionally, regulators across geographies are implementing regulations and data sharing agendas to synergize banks and FinTechs. This will give rise to open data, which will allow customers to share data across multiple industries. In turn, enterprises and providers are building new solutions, establishing partnerships, and undertaking mergers and acquisitions to strengthen their position in the marketplace.

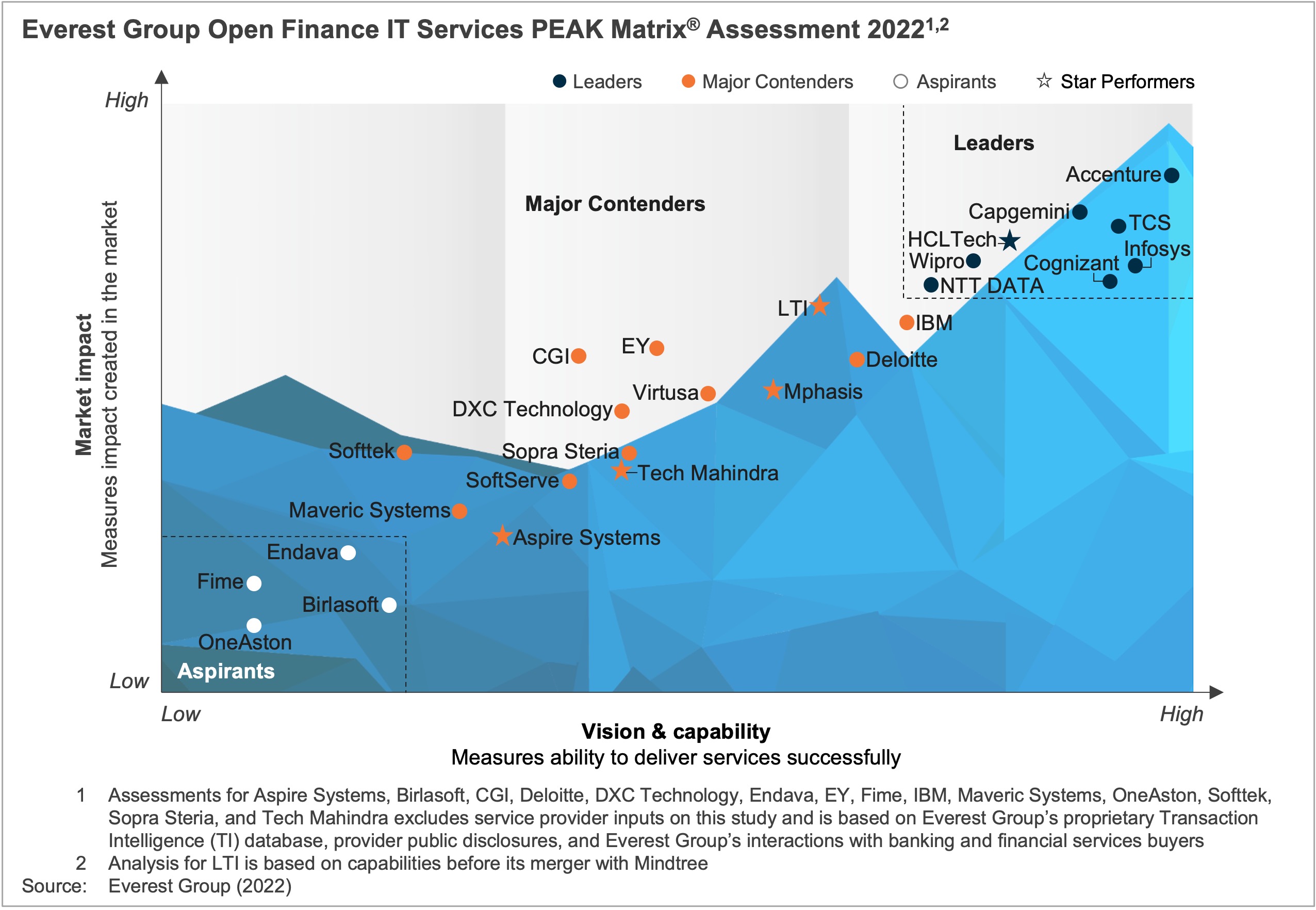

In this report, we assess 26 Banking and Financial Services (BFS) IT service providers’ vision & capability and market impact and position them on Everest Group’s PEAK Matrix® as Leaders, Major Contenders, and Aspirants. Each provider profile provides a comprehensive picture of its service focus, key Intellectual Property (IP) / solutions, domain investments, and case studies.

Scope:

- Industry: BFS

- Geography: global

- The assessment is based on Everest Group’s annual RFI process for the calendar year 2022, interactions with leading IT service providers, client reference checks, and an ongoing analysis of the open finance IT services market

Contents:

In this report, we:

- Classify 26 BFS IT service providers as Leaders, Major Contenders, and Aspirants on Everest Group’s proprietary PEAK Matrix® framework

- Examine key trends in the BFS open finance space

- Study IT service providers’ competitive landscape for open finance solutions

- Assess the key enterprise sourcing considerations (strengths and limitations) for each provider

Membership(s)

Banking and Financial Services Information Technology

Sourcing and Vendor Management

Page Count: 59

|

Other Users Also Viewed

PEAK Matrix® Report

8 Dec 2022

Global macroeconomic conditions, evolving customer preferences, supply-chain disruptions, regulatory scrutiny, and transforming operating models are driving Banking and Financial Services (BFS) firms to build resilient, scalable, and flexible risk…

|