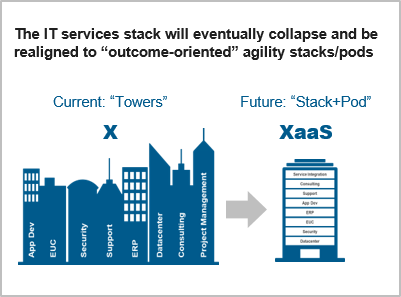

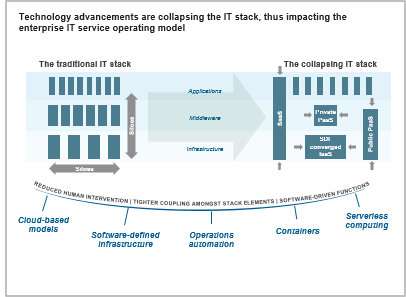

The rapid strides in technology in context of cloud-based delivery models, software-defined infrastructure, automation, containerization, and serverless computing are leading towards a collapsing technology stack, which is set to have a profound impact on the IT services operating models within enterprises. Currently, most enterprises follow the traditional siloed approach towards the delivery of IT services which needs to undergo significant overhaul to become agile and outcome-oriented, in order to deliver higher business value. The need for an overhaul in enterprise operations model presents significant opportunities for the IT service providers to differentiate themselves in the market.

This research provides fact-based trends impacting the cloud and Infrastructure Services (IS) market. It analyzes multiple aspects such as overall cloud and infrastructure services market size, leading players, deal sizes, deal durations, and pricing. Buyers of these services will gain by understanding these trends and evolving their sourcing portfolio accordingly. Service providers will benefit by aligning their strategy to cater to these trends.

Scope

- IT services market size (split across applications, consulting, infrastructure service, geography, and industry verticals)

- Market share of leading IT service providers in applications, consulting, and infrastructure services

- IS buyer adoption trends across geography, industry verticals, and revenue size

- Key trends shaping the cloud and IS market (Exploring “the collapsing tech stack”)

- Outlook for 2018

Content

This annual research deep dives into the cloud and IS landscape. It provides data-driven facts and perspectives on the overall market. The research covers cloud and IS adoption trends, demand drivers, and buyer expectations. The research analyses buyer challenges, trends shaping the market, and provides an outlook for 2018 for the broader IT as well as cloud and IS market.

For example, the section on “IS Deal trends” analyses the following:

- Deal size and duration

- Scope of services

- Pricing trends

- Anti-incumbency and new vs. renewal trends

- Buyer adoption by industry and size

- Buyer adoption by geography

Membership(s)

Cloud & Infrastructure Services