|

|

Banking BPO Annual Report 2017: Disruption Does Not Discriminate – Banks Embracing Digital to Stay Relevant

8 Sep 2017

by

Manu Aggarwal

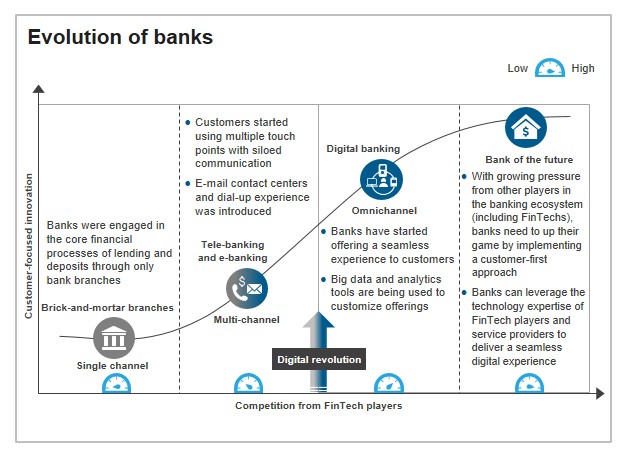

The banking industry continues to face existing challenges – rising cost pressures, depleting top line, decreasing customer satisfaction, and uncertainty in the geopolitical environment. However, the disruption in technology and its significant adoption by non-banks has led to a more pronounced effect on the existing challenges for banks. Banks have started to invest in technologies such as analytics and Robotic Process Automation to offer personalized solutions to customers. Going forward, banks can leverage their own scale and access to resources to co-exist with FinTechs and survive in the banking ecosystem.

Scope of analysis

Coverage across 25+ banking BPO service providers including Accenture, Avaloq, Capgemini, CGI, Cognizant, Concentrix, Conduent, DXC, Equiniti, EXL, Firstsource, Genpact, HCL, HP, IBM, Infosys, Intelenet, Mphasis, NIIT Technologies, Polaris, Sutherland, Syntel, TCS, Tech Mahindra, Wipro, and WNS.

Content

This report will assist key stakeholders (banks, service providers, and technology providers) understand the dynamics of the banking BPO market and help them identify the trends and future outlook. In this backdrop, this report provides comprehensive coverage of the global banking BPO market including detailed analysis of market size & growth, challenges faced by LoBs, technology adoption trends, and future outlook for banks. Some of the findings in this report are:

- The global banking BPO market is expected to grow at a steady pace of 5-9% over 2016-2020

- While North America continues to be the most significant market for banking BPO, Continental Europe and Asia Pacific have witnessed significant growth

- Bank LoBs are facing challenges to remain profitable with the pressure of regulations, competition from non-banks, and rising expectations of customers

- The traditional banking model with legacy technologies has reached the end of the growth curve; most banks are now focusing on new technologies such as analytics, Robotic Process Automation, and blockchain to survive

- The overall BPS industry has witnessed significant RPA adoption; however, its adoption in the banking BPO industry remains low

- Analytics in BFSI is starting to differentiate in its usage, and BFSI is poised to remain the largest market for analytics

- In the era of digital revolution in the industry and growing competition from non-bank players, banks need to up their game with a customer-first approach

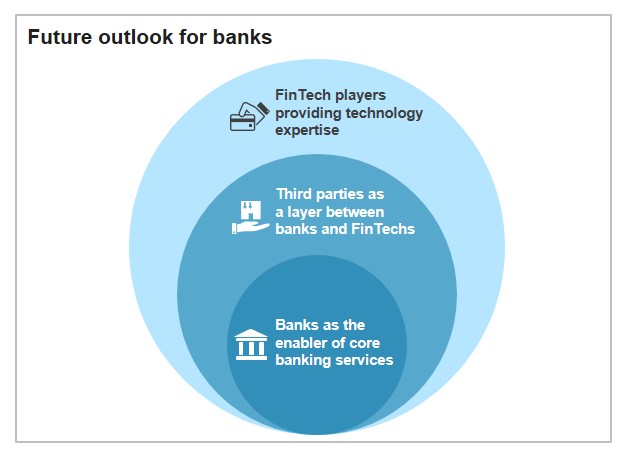

- To survive in the ecosystem and offset challenges, banks can combine core banking strengths with the technology expertise of FinTechs, creating a win-win situation for both parties

Membership(s)

Banking and Financial Services (BFS) - Business Process Outsourcing (BPO)

Page Count: 49

|

Other Users Also Viewed

Provider Compendium Report

8 Feb 2024

Over the past year, enterprises have faced significant macroeconomic and geopolitical challenges. The potential uncertainties surrounding the implementation of the Inflation Reduction Act (IRA), the escalation in federal interest rates aimed at curbi…

|