|

|

Future of Banking – “Experience First”: Banking ITO Annual Report 2017

6 Sep 2017

by

Aaditya Jain, Archit Mishra, Jimit Arora, Ronak Doshi

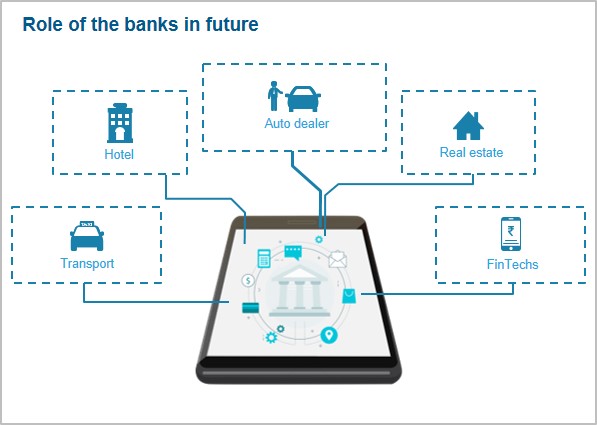

As banks embark on the digital transformation journey, they will move from a banking-as-a-product model to banking-as-a-service model. Signs of this transformation can already be witnessed in Europe, where the Payment Service Directive II (PSD2) has mandated banks to open their core through Application Programming Interfaces (APIs). Banks are moving toward a plug-and-play model that will allow multiple participants (sellers and buyers) to connect to them to gain value.

In the future, banks will become more and more invisible and will be ambient. Link to banking will be integrated into every end-user device / business system and will become part of our lifestyle, on the lines of Facebook or Google. Banks will become a network of assets and instead of capital, will offer end-to-end customer experiences.

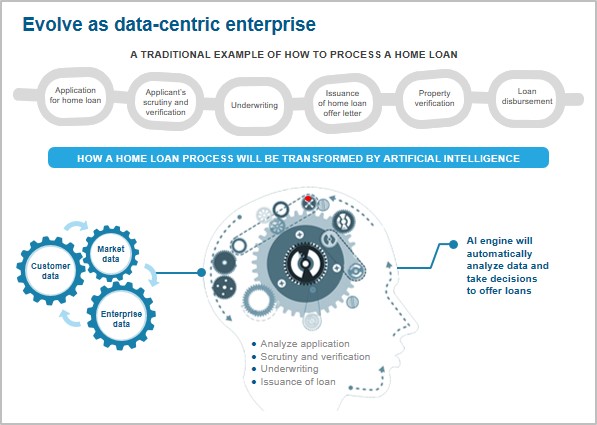

Further, they will also need to reorient themselves to a customer-centric model, which would require changes in business processes, IT architecture, culture, as well as operating model.

In this report, we look at trends in the banking industry and their implication for application services outsourcing. We focus on:

- Reimagining the future of banking

- Implications for enterprises and service providers

- Market trends and activity for large AO relationships in banking

SCOPE OF THIS REPORT

- Industry: Banking (retail banking, commercial banking, credit cards, loans, and mortgages); excludes capital markets and insurance

- Services: Large (TCV > US$25 million), multi-year (>three years), and annuity-based application outsourcing deals as well as small-sized, short duration deals

- Geography: Global

- Sourcing model: Third-party AO transactions; excludes shared services or Global In-house Centers (GICs)

CONTENT

This report is structured across two key sections, each containing insights into application outsourcing in the global banking sector:

- Reimagining the future of banking: The changing role of banks from being a product provider to an experience provider. Current gaps and recommendations on their transition to be more and more invisible and ambient

- Banking AO market overview: Analysis specific to the banking AO market with a focus on large transactions:

- Market size of global banking AO

- Trends and characteristics for large-sized transactions in banking AO

- Demand characteristics for banking AO services by lines of business, AO subfunctions, geography, and digital themes

- Renewal activity

Membership (s)

Banking, Financial Services & Insurance (BFSI)-ITO

Page Count: 56

|

Other Users Also Viewed

16 Nov 2018

Disruption in technology, rise of millennials, and competitive marketplace are leading to disintermediation in the value chain and business models of traditional banks. To keep pace with the digital change, banks are aligning with digital-first opera…

|