|

|

Property and Casualty (P&C) Insurance BPO Annual Report – Embracing the Digital-First

30 Jun 2017

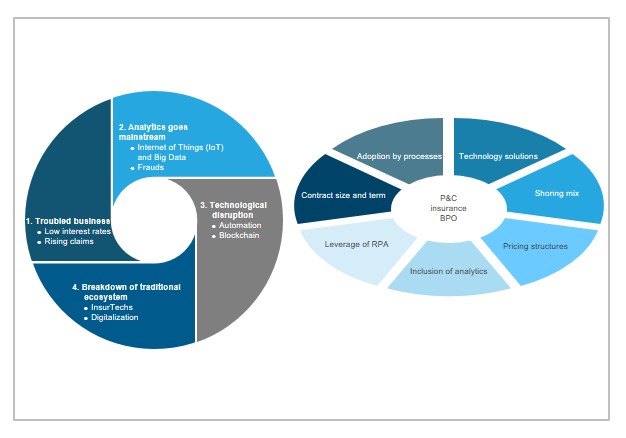

The continuum of challenges for the traditional P&C insurers is demanding them to revamp their strategy and operations. Challenges, such as pressures on profitability, tough macroeconomic conditions, competition from emerging digital players, fraud, and inefficient legacy technology infrastructure, are pushing them to develop non-traditional capabilities and optimize cost of insurance operations. This is driving the adoption of outsourcing in P&C insurance.

The P&C insurance BPO market continues to grow at a healthy rate of nearly 13%. While the adoption of outsourcing by first-generation buyers is driving growth, inclusion of more complex, judgment-intensive tasks, such as underwriting, claims adjustment, analytics, risk management, actuarial, and regulatory reporting is boosting it further.

First-generation buyers are outsourcing P&C insurance operations for access to technology solutions and cost reduction. The expectations of tenured buyers are much more evolved as compared to those of the new ones. They are demanding value addition, assistance in expanding their businesses, reducing time-to-market, getting higher customer mindshare, and building multi-channel capabilities from service providers.

Service providers, on the other hand, are responding to the evolving buyer demands by developing better solutions, augmenting their capabilities to deliver judgment-intensive processes, and offering value addition via analytics and automation.

Scope and Methodology

- Proprietary database of ~300 P&C insurance BPO contracts (updated annually)

- Coverage of 20+ P&C insurance BPO service providers including Accenture, Capgemini, Capita, Cognizant, Conduent, DXC, EXL, Genpact, HCL, Infosys, Intelenet, MphasiS, NIIT Technologies, Shearwater Health, Sutherland Global Services, Syntel, TCS, and WNS

Content

This report provides comprehensive coverage of the global P&C insurance BPO market, including adoption trends across geographies & buyer size, factors impacting the market, key solution characteristics, emerging trends, and service provider landscape. It will assist key stakeholders (P&C insurers, service providers, TPAs, and technology providers) to understand the changing dynamics of the P&C insurance BPO market and identify the upcoming trends. Some of the findings in this report are:

- The P&C insurance BPO market has grown at a high CAGR of ~13% over last four years and is expected to grow at 12-14% in next few years

- While North America continues to lead the P&C insurance BPO adoption with over three-fourths of the total contracts, United Kingdom and other geographies, such as Australia and Europe, are driving outsourcing adoption

- Expansion of scope to include some of the judgment-intensive pieces traditionally managed by Third Party Administrators (TPAs) is boosting the growth

- Small and mid-sized buyers are now signing more comprehensive deals as compared to earlier times

- Increasing adoption of automation along with higher adoption of platform-based solutions within P&C insurance contracts is reducing the FTE-intensive play in transaction-based processes such as claims management

- A lot of insurers across the globe are evaluating/piloting the Blockchain technology; in response to the rising interest, service providers are developing solution to leverage Blockchain

Membership(s)

Insurance BPO

Page Count: 63

|

|