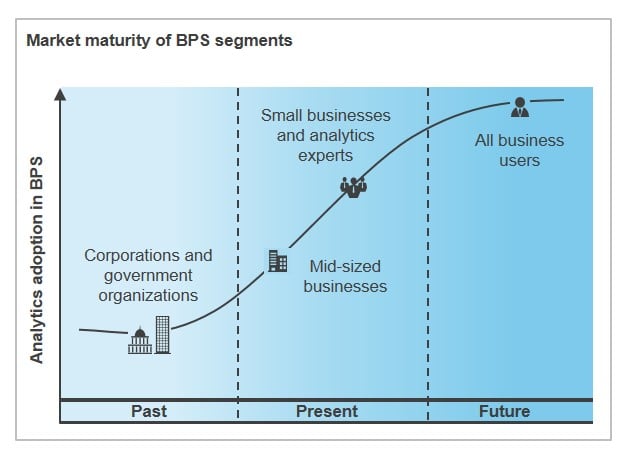

Witnessing a robust growth of 25-28% over 2015-2016, the global analytics BPS reached a market size of over US$5 billion at the end of 2016. The last 12-18 months have witnessed evolving buyers demanding end-to-end analytics solutions and technologies with the flexibility to choose amongst multiple options that would allow them to derive better and actionable insights in real time. The changing buyer demand and intensifying competition in the market is causing a shift in the analytics solutions offered – from stand-alone to enterprise-wide solutions and integration of basic as well as advanced solutions.

Scope of analysis

Coverage across 15+ analytics BPS service providers including Absolutdata, Aegis, Accenture, Bridgei2i, Capgemini, Cognizant, EXL, Fractal Analytics, Genpact, IBM, Infosys, Latentview, NTT Data, TCS, Tech Mahindra, Wipro, and WNS.

Content

This report will assist key stakeholders (buyers, service providers, and technology providers) understand the dynamics of the analytics BPS market and help them identify the trends and outlook for 2016-2017. In this backdrop, this report provides comprehensive coverage of the global analytics BPS market including detailed analysis of market size & growth, buyer adoption trends, analytics BPS value proposition & solution characteristics, and service provider landscape. Some of the findings in this report are:

- While North America continues to be a key buyer geography driven by adoption in the United States, UK has quickly ramped-up the use of analytics

- BFSI and CPG & retail are the leading adopters of analytics BPS; healthcare, energy & utilities, hi-tech & telecom, and government have also witnessed robust growth in the last 12-18 months

- With growing buyer maturity and competition in the market, service providers are increasingly offering advanced analytics solutions (predictive and prescriptive analytics)

- India continues to be the most preferred delivery location for analytics services and has witnessed penetration by service providers in tier 2/3 locations

- Significant interest in new areas such as IoT and AI will lead to a huge demand for related tools and technologies in the future

- With growing maturity of the market, buyers demand an end-to-end technology capability and the flexibility to choose different combinations from service providers

- While the service provider landscape is divided between specialists and BPO providers, their capabilities have converged over the years. BPO providers are now building advanced analytics capabilities and specialists are also adding basic reporting and dashboarding capabilities to their product portfolio

- The list of the largest players across industries is dominated by BPO players that have built all-round capabilities and can leverage their broader BPO relations to drive business growth

Membership(s)

Banking and Financial Services (BFS) - Business Process Outsourcing (BPO)

Contact Center Outsourcing

Insurance - Business Process Outsourcing (BPO)

Healthcare & Life Sciences Business Process Outsourcing

Finance & Accounting Outsourcing

Human Resources Outsourcing (HRO)

Managed Service Provider

Procurement Outsourcing

Recruitment Process Outsourcing