|

|

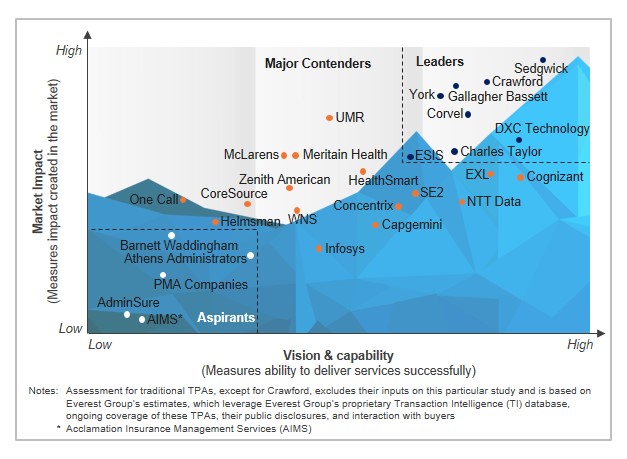

Insurance Third Party Administrator (TPA) – Service Provider Landscape with Services PEAK Matrix™ Assessment 2018

29 Jun 2018

by

Somya Bhadola

The global insurance TPA market is getting more dynamic owing to a number of acquisitions/partnerships and rise of “BPO-heritage TPAs”.

On the demand side, owing to unfavourable macroeconomic conditions, tightening regulatory regimes, profitability pressures, and the rise of digital-savvy customers, insurance firms are now showing more inclination towards outsourcing than ever before. They used to outsource different and specific processes to TPAs and BPOs. More recently, insurers have started looking for “one-stop solution” instead of having multiple relationships for different processes. While both “traditional TPAs” and “BPO-heritage TPAs” have their own value propositions, insurers want to realize the benefits of both the worlds.

Driven by this demand, TPAs and BPO providers have started expanding their expertise in processes beyond the traditional areas and now, often cut each other’s paths. As both “traditional TPAs” and “BPS-heritage TPAs” evolve, more head-on competition is expected going forward.

Scope and Methodology

In this research, we analyze the global insurance TPA landscape. We focus on:

- Relative positioning of 29 TPAs on Everest Group’s PEAK Matrix for insurance TPA services

- TPAs’ market success

- TPAs’ capability assessment across key dimensions

- Key strengths and areas of improvement for TPAs

Content

This report examines the global insurance TPA market and its service provider landscape. It provides detailed analysis of the capabilities and market impact of TPAs and their relative position on the Everest Group PEAK Matrix. It will assist key stakeholders (insurers, TPAs, and technology providers) understand the current state of the insurance TPA landscape.

- Insurance TPA PEAK Matrix 2018 positioning is as follows:

- Leaders: Charles Taylor, Corvel, Crawford, DXC Technology, ESIS, Gallagher Bassett, Sedgwick, and York Risk Services

- Major Contenders: Capgemini, Cognizant, Concentrix, CoreSource, EXL, Helmsman, HealthSmart, Infosys, McLarens, Meritain Health, NTT Data, One Call, SE2, UMR, WNS, and Zenith American

- Aspirants: Acclamation Insurance Management Services (AIMS), AdminSure, Athens Administrators, Barnett Waddingham, and PMA Companies

- Market share assessment of 29 TPAs by:

- Revenue

- Geography (signing region)

- Lines of businesses (P&C insurance, workers’ compensation, L&P insurance, and health insurance

- Everest Group’s assessment and remarks on 29 TPAs

Membership(s)

Insurance - Business Process Outsourcing (BPO)

Page Count: 67

|

|