Lending IT Services PEAK Matrix® Assessment 2023

PEAK Matrix® Report

The lending industry is currently undergoing a significant transformation, propelled by the increasing demand for technological integration to enhance operational efficiency, user experience, and cost-effectiveness. This shift is largely driven by the widespread adoption of advanced cognitive tools, such as AI and predictive analytics, enabling lenders to improve automated approval rates and gain deeper insights into customer behavior. Additionally, the rise in delinquencies, stemming from a growing disparity between wage growth and expenses, is prompting lenders to embrace more user-friendly online tools for flexible payments.

In response to these challenges, lenders are leveraging cloud computing and alternative data to revolutionize underwriting and data management processes. The introduction of innovative products such as green mortgages and Buy Now Pay Later (BNPL) options addresses modern consumer demands within a framework aimed at consolidating products for improved efficiency. Moreover, the lending ecosystem is increasingly becoming API-driven, facilitating real-time integrations with third parties and offering flexible customer experiences without the need for costly in-house functionalities. This trend is evident across various sectors, with mortgage lending investing in technology and alternative products, and auto financing transitioning toward subscription and shared ownership models. Particularly in commercial and SME lending, there is a noticeable shift toward streamlined online financing experiences and platform modernization.

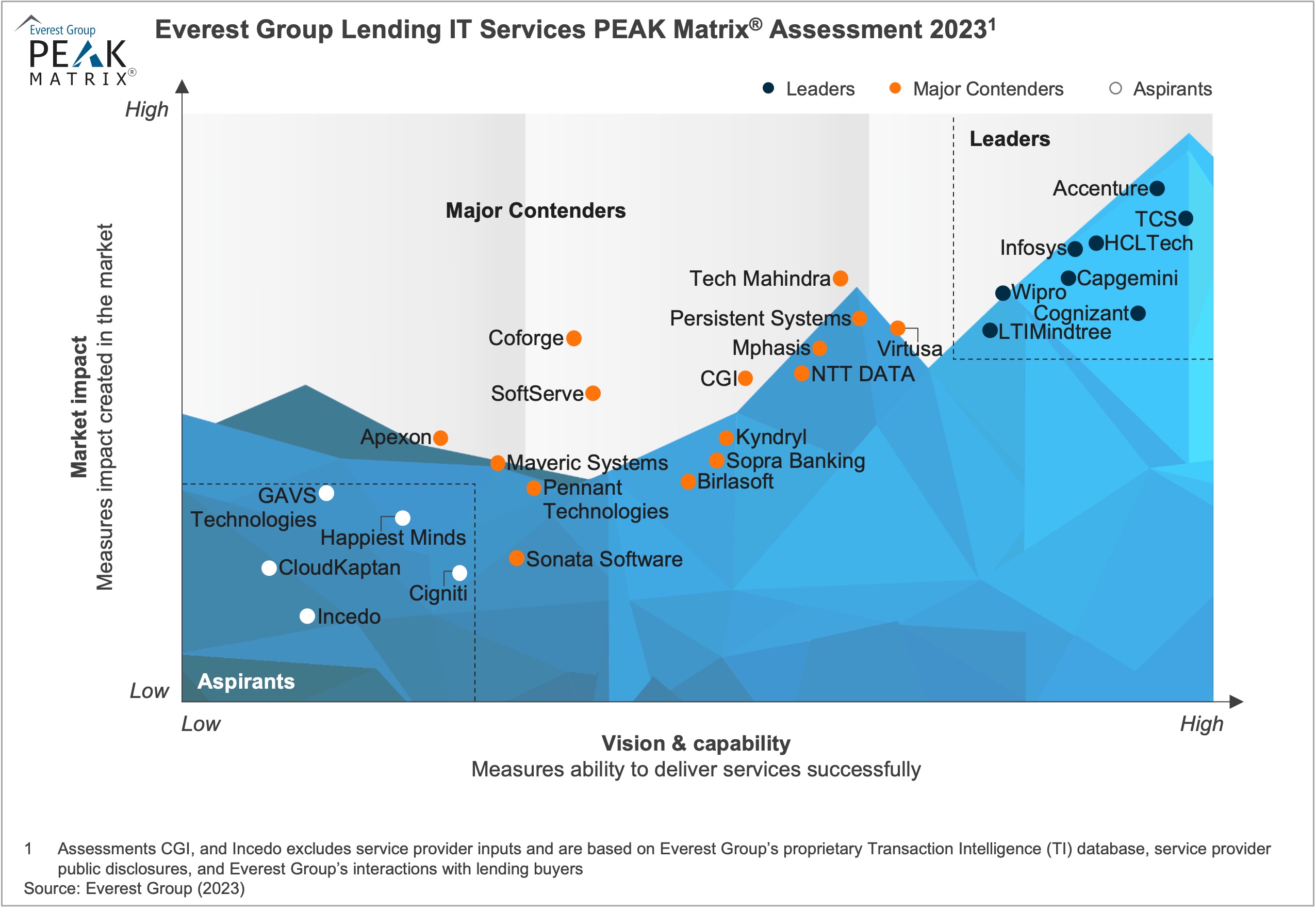

In this report, we analyze 28 lending IT service providers and position them on Everest Group’s proprietary PEAK Matrix® framework as Leaders, Major Contenders, and Aspirants.

Scope

- Industry: Banking and Financial Services (BFS)

- Geography: global

- The assessment is based on Everest Group’s annual RFI process for the calendar year 2023, interactions with leading technology and IT services providers, client reference checks, and an ongoing analysis of the lending IT services market

Contents

In this report, we:

- Examine key trends in the lending IT services industry

- Classify 28 lending IT service providers as Leaders, Major Contenders, and Aspirants on Everest Group’s proprietary PEAK Matrix® framework

- Discuss the IT service providers’ competitive landscape for lending IT services in BFS

- Assess providers’ key strengths and limitations