UK Contingent Staffing Services PEAK Matrix® Assessment 2023

PEAK Matrix® Report

The UK contingent staffing industry experienced contraction in 2020 due to the pandemic, and the use of contingent staffing plummeted throughout the country. As the industry began to recover in 2021, there was accelerated growth in the second half of the year and demand for contingent talent surged due to a rapid rise in talent demand-supply gap, labor pyramid distortion, and the Great Resignation. Providers tapped into this opportunity and improved their sourcing capabilities to meet enterprises’ increasing demands. In addition, domains such as DE&I, upskilling and reskilling, and managed services gained prominence and became the key differentiating factors among providers.

This report examines the dynamics of the contingent staffing provider landscape in the UK and its impact on the UK contingent staffing market (overall staffing and IT staffing) in 2021. It provides an overview of the market and analyzes the domains in which providers have differentiated themselves. The report also positions 21 contingent staffing providers on Everest Group’s PEAK Matrix® as Leaders, Major Contenders, and Aspirants.

Scope

Industry: contingent staffing

Geography: UK

Contents

The report analyzes the performance of 21 contingent staffing providers and examines:

- The UK contingent staffing provider landscape

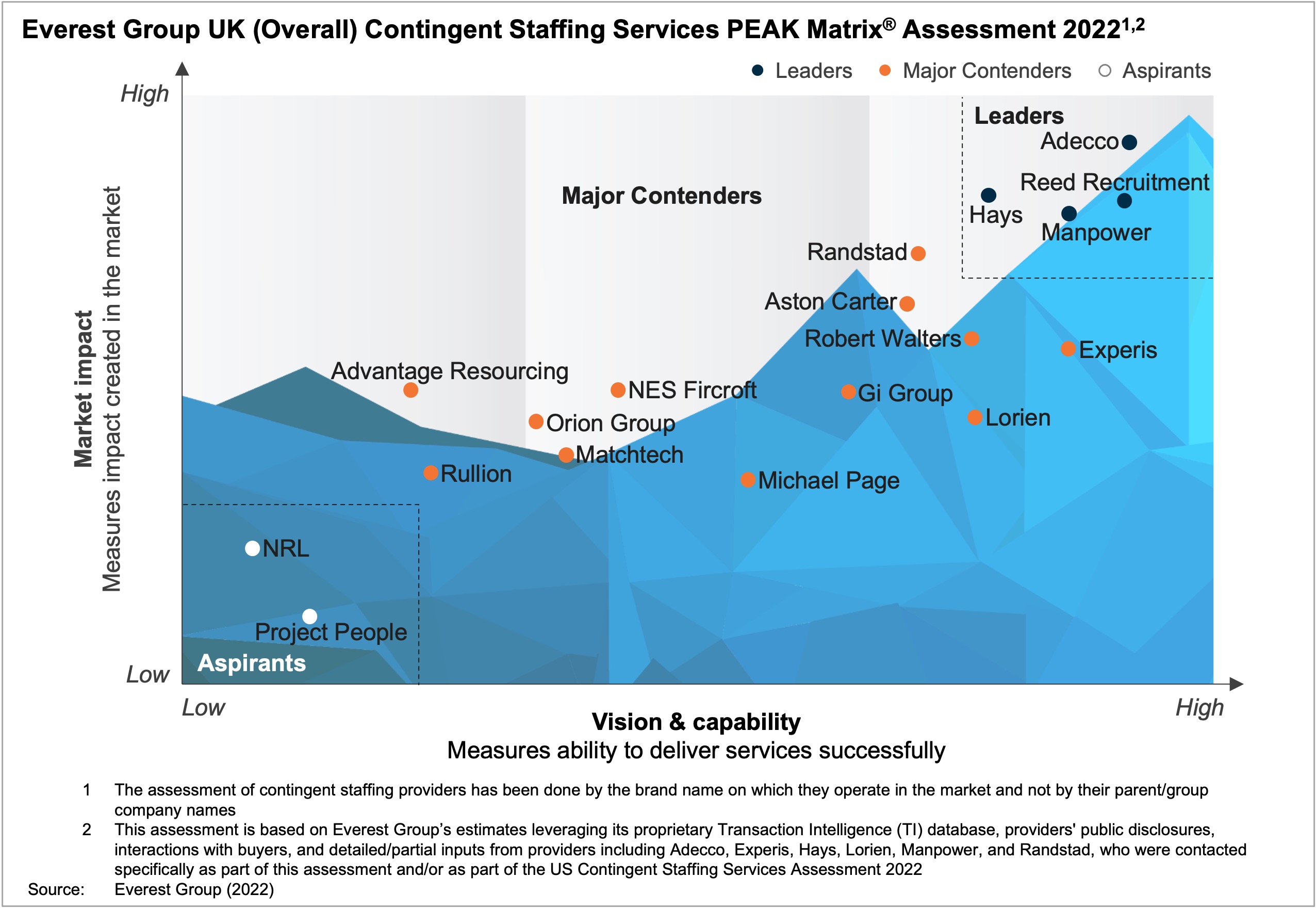

- UK (Overall) Contingent Staffing Provider PEAK Matrix® Assessment: classification of 18 contingent staffing providers into Leaders, Major Contenders, and Aspirants on Everest Group’s proprietary PEAK Matrix® framework

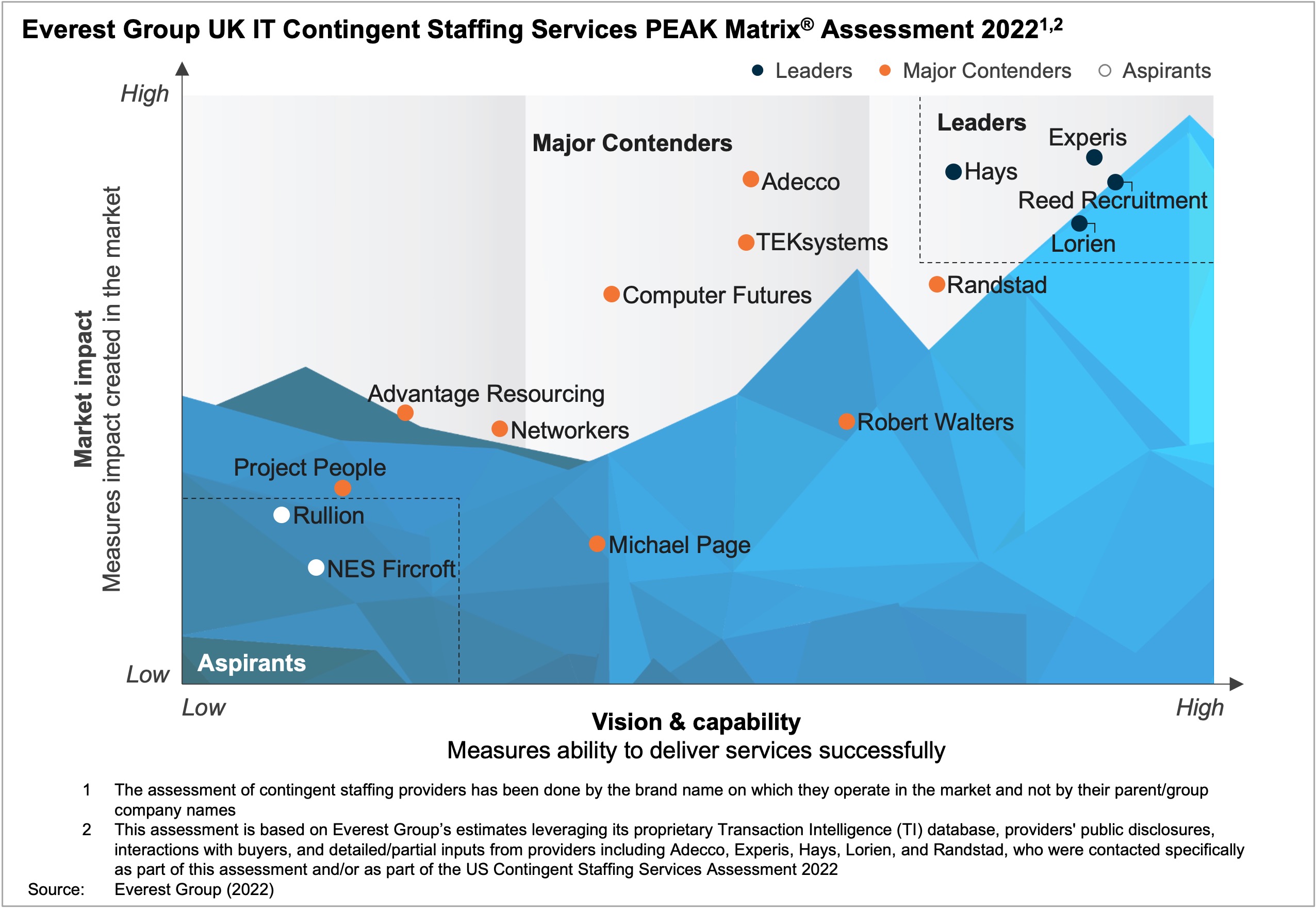

- UK IT Contingent Staffing Provider PEAK Matrix® Assessment: classification of 15 contingent staffing providers into Leaders, Major Contenders, and Aspirants on Everest Group’s proprietary PEAK Matrix® framework

- Everest Group analysis of providers:

- UK contingent staffing providers’ capabilities assessment on seven dimensions: market adoption, portfolio mix, value delivered, scope of services offered, innovation & investments, delivery footprints, and vision & strategy

- Remarks on key strengths and limitations of each contingent staffing provider