Financial Crime and Compliance (FCC) Operations – Services PEAK Matrix® Assessment 2022

PEAK Matrix® Report

Financial Crime and Compliance (FCC) operations continue to grow within the Banking and Financial Services (BFS) industry. Given the increase in regulatory norms and technology advances, banks, financial institutions, and other emerging institutions are constantly working to meet these norms and safeguard themselves from financial crimes, while maintaining their operational costs and scaling their delivery. New regulations in the financial sector call for a dynamic regulatory compliance check, which is difficult for these institutions to manage globally. The pandemic and the looming threat of a recession have added to the woes of financial institutions and impacted agent availability, operational costs, and transaction volumes.

The growing demand for FCC support and digital has opened opportunities for service providers to augment their capabilities and add offerings for advisory, platform-led services, and advanced digital solutions. For buyers, the need to increase efficiency and productivity by reducing false positives and manual intervention, as well as by mitigating profile risks, remains paramount. Service providers now have the opportunity to go beyond managing operations and transforming engagements into strategic partnerships.

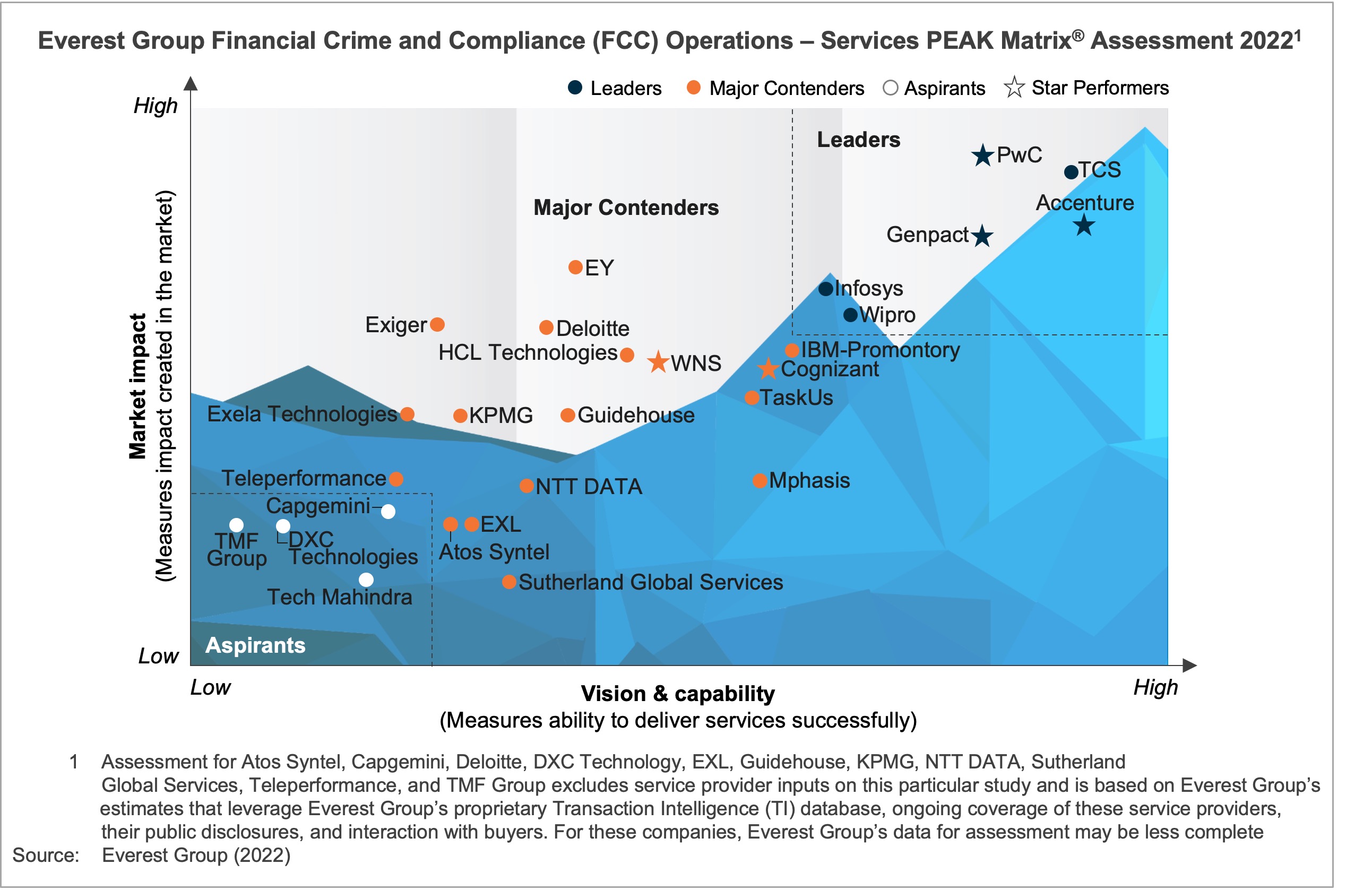

This report provides a detailed analysis of the vision, delivery capabilities, and market successes of 27 FCC operations service providers and their relative position on the Everest Group PEAK Matrix® for FCC Operations. The study will assist key stakeholders, such as banks, financial institutions, FinTechs and RegTechs, service providers, and technology providers, in understanding the current FCC service provider landscape and help them in their sourcing and partnership decisions.

Scope

- Industry: banking and financial services

- Sub-industry: financial crime and compliance

- Geography: global

- In this report, we cover vertical-specific FCC operations. We have not covered horizontal business processes, such as Finance and Accounting (F&A), Human Resources (HR), procurement, and contact center

Contents

This report features 27 FCC operations service provider profiles, each of which includes:

- Relative positioning of the service provider on Everest Group’s PEAK Matrix® for FCC Operations

- Service provider market impact

- Service provider vision and capability assessment across key dimensions

- Enterprise sourcing considerations