Rewards and Recognition (R&R) Solutions PEAK Matrix® Assessment with Service Provider Landscape 2021

PEAK Matrix® Report

The year 2020 was eventful for the Rewards and Recognition (R&R) industry, as the pandemic emphasized the importance of R&R solutions to maintain employee engagement and motivation, coupled with overall well-being and development. Notably, while the pandemic impacted the rewards budget and related decision-making process, it also drove the demand for robust and technology-enabled employee experience solutions.

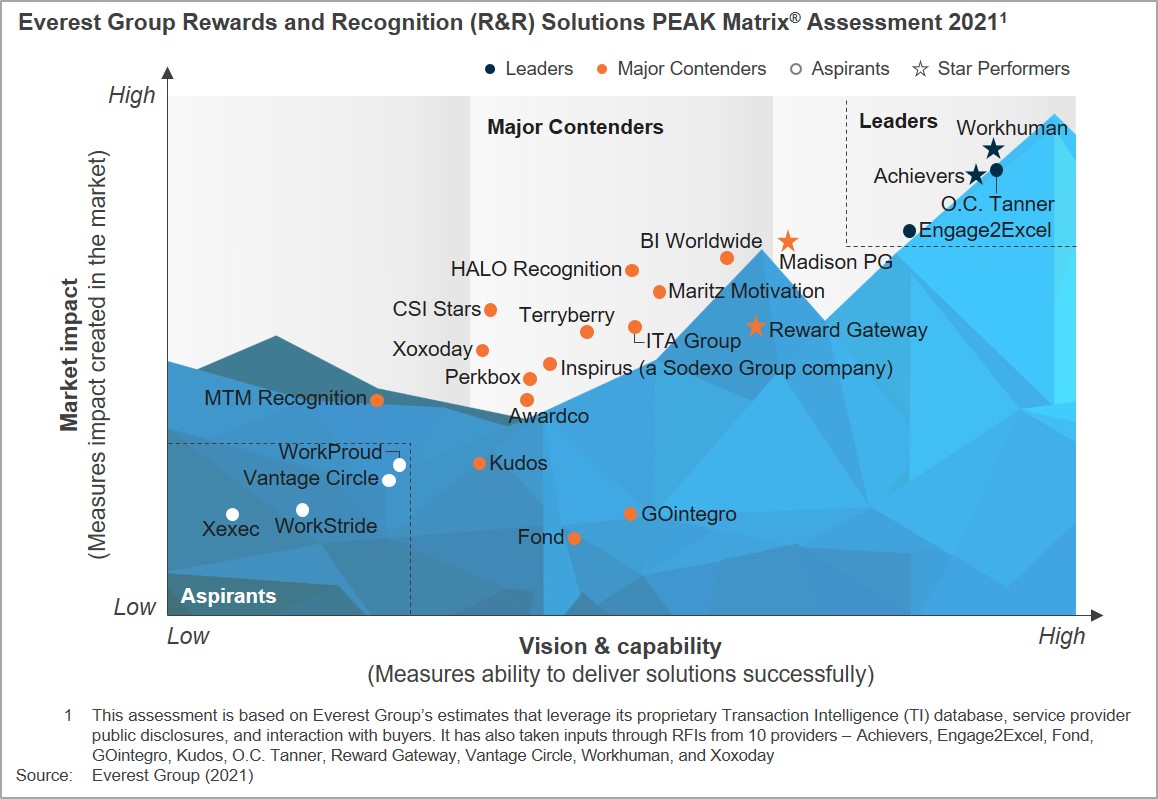

In this research, we present detailed assessments of 24 R&R providers featured on the R&R Solutions PEAK Matrix® 2021. Each assessment provides a comprehensive picture of the provider’s market success, portfolio mix, value delivered and buyer feedback, vision, technology and service capability, investments, and engagement and commercial model. The assessment is based on Everest Group’s annual RFI process for the calendar year 2020, interactions with leading R&R vendors, client references, and an ongoing analysis of the market.

Scope

All industries and geographies

Vendors evaluated: Achievers, Awardco, BI Worldwide, CSI Stars, Engage2Excel, Fond, GOintegro, HALO Recognition, Inspirus (a Sodexo Group company), ITA Group, Kudos, Madison PG, Maritz Motivation, MTM Recognition, O.C. Tanner, Perkbox, Reward Gateway, Terryberry, Vantage Circle, Workhuman, WorkProud, WorkStride, Xexec, and Xoxoday

Contents

In this research, we analyze the R&R provider landscape and evaluate how the providers shape up in terms of their market impact and vision & capability. In particular, we focus on:

- The R&R Solutions PEAK Matrix®

- Competitive landscape of the R&R market in terms of market share, number of employees managed, and geographic presence

- Key enterprise sourcing considerations (strengths and limitations) that enterprises should be aware of for each of the 24 R&R providers