|

|

Contact Center Outsourcing Annual Report 2018: Transforming Customer Experience Through a Digital-First Approach

14 Sep 2018

by

Sharang Sharma

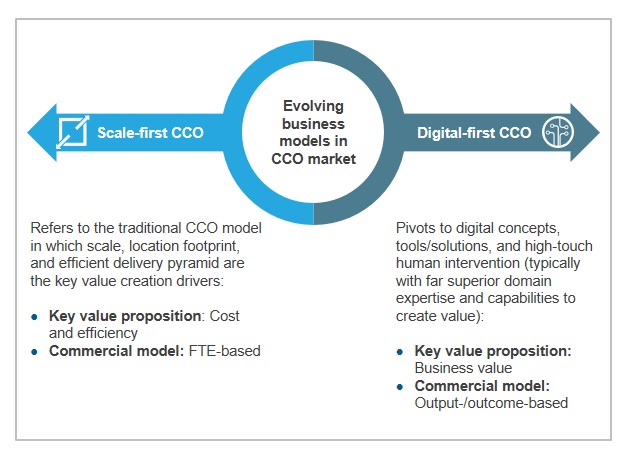

Contact centers are transforming to adopt a digital-first approach, as many enterprises regard CX improvement as one of their top strategic priorities. This has fundamentally transformed the CCO market, as enterprises increasingly look for service providers who can partner with them and implement innovative solutions to transform their CX.

The evolving buyer requirements have had an impact on the solution trends in the CXM market and CCO service providers are continuing to invest in developing differentiated capabilities that include consultative engagement model, omnichannel platforms, automation, analytics, talent model, and omni-shoring delivery model. These emerging growth avenues for service providers have been the key drivers for increased market growth of ~4% in 2017. The CCO market is expected to grow further at a rate of 4-5% to reach US$91-93 billion by 2020.

Scope of analysis

- Database of over 3,000+ CCO contracts; does not include shared services or Global In-House Centers (GICs)

- Coverage across over 35+ CCO service providers including, Aegis, Alorica, Arvato, Atento, Capita, CGI, Concentrix, Conduent, Conduit Global, Contax, Convergys, DXC Technology, EXL, Firstsource, Genpact, HCL, Hexaware, HGS, Infosys, Intelenet, Knoah Solutions, NTT Data, Sitel, SPiCRM, Startek, Sutherland Global Services, Sykes, TCS, Tech Mahindra, Teleperformance, TTEC, Transcom, VXI, Wipro, Webhelp, and WNS

Content

This report will assist key stakeholders (buyers, service providers, and technology providers) understand the changing dynamics of the CCO market and help them identify the trends and outlook for 2018-2019. In this backdrop, the report provides comprehensive coverage of the global CCO market including detailed analysis of the market size & growth, buyer adoption trends, CCO value proposition & solution characteristics, and service provider landscape. Some of the findings are:

- The global contact center spend stands at US$320-350 billion, of which third-party outsourcing accounts for ~26%

- The CX needs of enterprises are evolving, and these require gaining an in-depth understanding of customers, sourcing the relevant technology capabilities to deliver personalized CX, and developing highly-qualified talent pool for managing CX

- The digital outsourcing drivers for enterprises, such as access to better technology, analytics, and multi-channel / omnichannel solutions are increasingly becoming more important than the traditional outsourcing drivers

- The delivery model for CXM services is evolving with a balanced mix of onshore, offshore, and nearshore agents, augmented with WAHA model and next-generation technology solutions. The WAHA model continues to grow in CXM services, with around 93% of the total WAHA agents based out of the United States

- The adoption of chat and social media has increased significantly over the past two years, compared to email and voice; chat has become the most preferred channel among millennials.

- RPA and rule-based chatbots are increasingly adopted across multiple use cases in contact centers to solve key business problems such as longer AHT, average waiting times, and navigating through multiple systems and applications. AI is largely leveraged to unlock customer insights, predict customer actions, and make personalized recommendations

- The operational analytics solutions such as desktop analytics and agent performance analytics have witnessed high adoption in contact centers. The adoption of business analytics solutions that include customer analytics, sentiment analytics, and Voice of Customer Analytics (VoCA) is expected to increase over the next few years

Membership(s)

Contact Center Outsourcing (CCO)

Page Count: 63

|

|