|

|

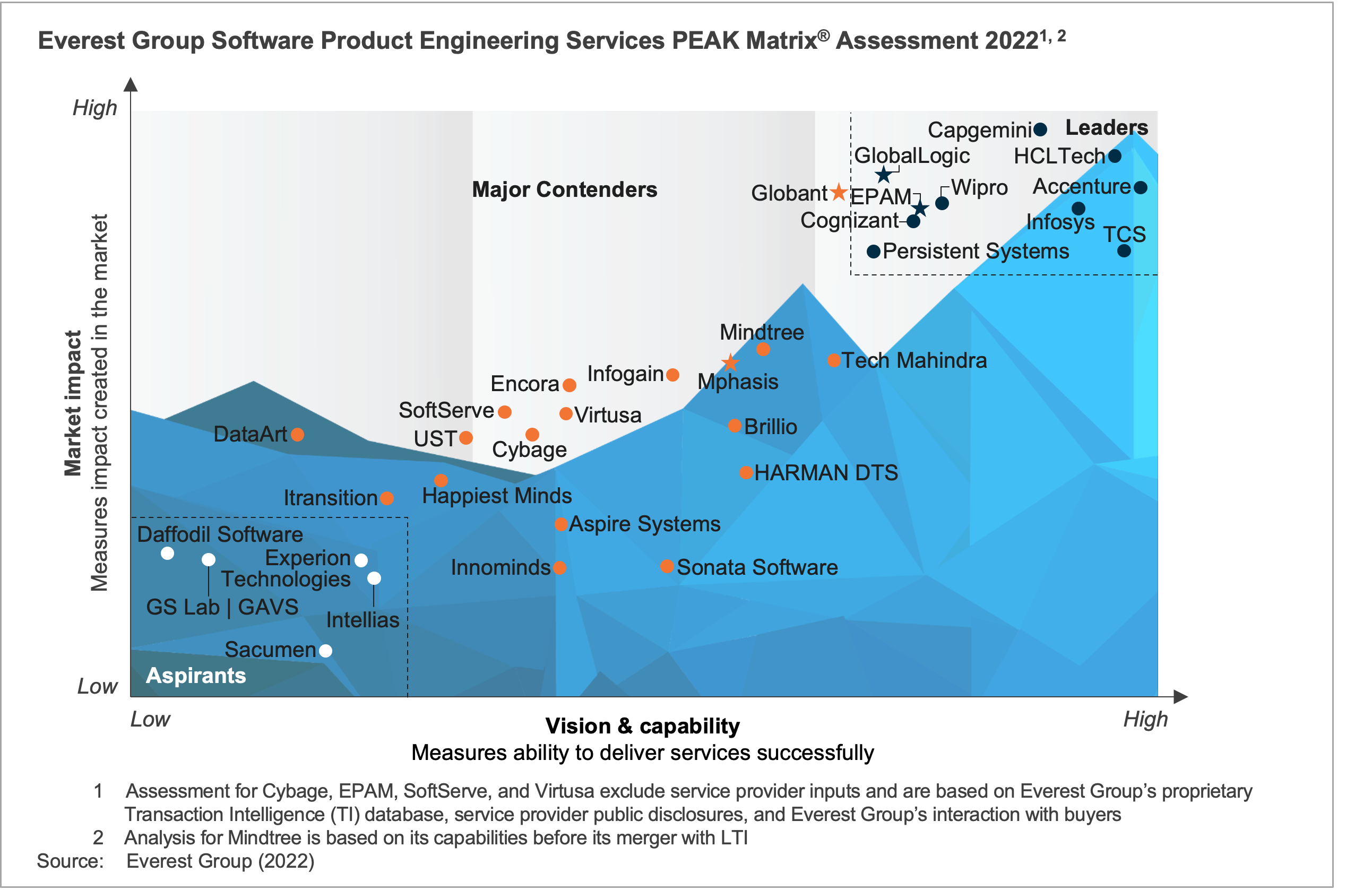

Acing the Art of Platform-driven Growth: Software Product Engineering Services PEAK Matrix® Assessment 2023

PEAK Matrix® Report

14 Dec 2022

by

Akshat Vaid, Mayank Maria, Riya Agrawal, Marut Shukla, Agnivesh Tripathy

Software, the largest spending segment in product engineering, continues to grow in relevance as platform-based business models take center stage for enterprises in both product- and services-centric verticals.

This shift toward platforms is leading to the emergence of new dynamics, including:

- increased intimacy between business and technology/engineering functions

- lower tolerance for technical debt; the need to manage/retire platform-related legacy systems rapidly and effectively is more pronounced

- the build and maintain mindset is giving way to a focus on ongoing platform evolution

While the new dynamics have exponentially increased the demand for engineering talent, the geopolitical situation in Eastern Europe is worsening the already supply-constrained talent market. Engineering service providers are playing a vital role in this situation and helping their clients with scaled, persistent, and diversified engineering teams.

This research, the fourth edition of Everest Group’s Software Product Engineering PEAK Matrix® assessment, evaluates 33 engineering service providers on the PEAK Matrix® framework for their overall and vertical-specific software product engineering capabilities and market impact, and shares insights on enterprise sourcing considerations.

Scope

- Services: software product engineering services

- Geography: global

- The study is based on RFI responses from service providers, interactions with their software product engineering services leadership, client reference checks, and an ongoing analysis of the engineering services market.

Contents

In this report, we share:

- Everest Group’s services PEAK Matrix® evaluation of engineering service providers associated with software product engineering services

- Categorization and characteristics of Leaders, Major Contenders, and Aspirants

- Evaluation of service providers across five verticals – Banking, Financial Services and Insurance (BFSI); healthcare; Independent Software Vendors (ISVs); media and entertainment; and retail

- A summary dashboard assessing market impact and vision & capability of each service provider

- The key strengths and limitations of each of the 33 software product engineering service providers featured in the assessment

Membership(s)

Engineering Services

Sourcing and Vendor Management

Page Count: 67

|

|