Optimizing Governance, Risk, and Compliance (GRC) spend has become one of the top concerns for enterprises across industries. Increasing costs to manage emerging risks, adhere to stringent compliance requirements, and modernize legacy GRC systems to support digital adoption is creating a strong demand for next-generation regulatory solutions and services.

Moreover, the increase in complexity of regulations is causing enterprises to think of a dynamic GRC model to rapidly adopt to technology-led regulations and avoid heavy penalties.

Startups are disrupting the GRC space by applying emerging technologies and innovative operating and business models to exploit the GRC opportunity, and thus building an extended “the RegTech ecosystem”

Startups are driving innovation across GRC categories using digital technologies such as Artificial Intelligence (AI), Machine Learning (ML), analytics, cloud, Application Programming Interface (API), automation, and blockchain. The RegTech buzz is being fueled by significant investments from venture capitalists, partnerships with large established players, and support from regulatory bodies

In this research we have assessed RegTech startups, primarily focusing on their growth, investor confidence, quality & impact of their solution offerings, and the brand recognition they have created in the market

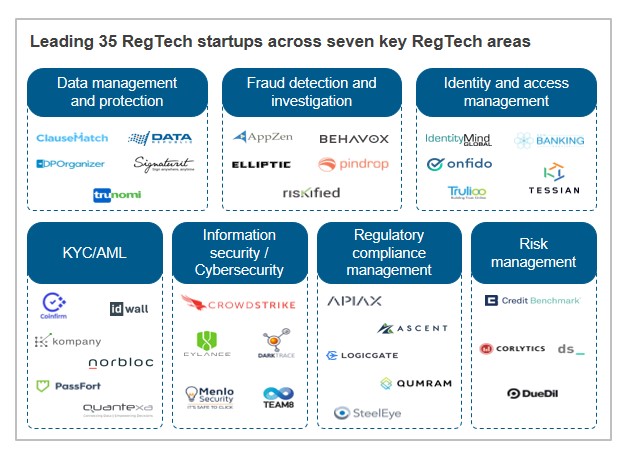

We have shortlisted 35 RegTech startups across seven categories of the RegTech ecosystem, as well as provided a brief overview of each startup including key technology levers used by each one

SCOPE OF THE ANALYSIS

- Industry: Regulatory Technology (RegTech) in BFS

- Geography: Global

Membership(s)

Banking and Financial Services (BFS) – IT Services