Health and Welfare Benefits Administration Outsourcing (H&W BAO) is one of the most compliance-driven markets in the HRO space. It grew at a steady rate of ~9% to reach US$3.7 billion in annualized revenue in 2017. H&W benefits administration outsourcing market accounts for ~45% of the overall BAO market (US$8-8.5 billion). This is primarily driven by an increase in the first-generation outsourcers, that are looking to meet the regulatory requirements in a cost-effective and compliant manner. Small market enterprises (with <3,000 employees) have emerged to be the largest adopter of H&W BAO solutions, with 47% market share.

The change in the buyer preferences was another major highlight. Along with the traditional drivers of cost reduction and process efficiency, upcoming drivers, such as access to technology solutions, domain expertise, and employee experience, are increasingly becoming relevant for the buyers. With their understanding of the regulatory environment and confidence in the outsourcing construct improving constantly, buyers expect a holistic benefits experience.

To tackle the evolving customer needs, service providers are trying to expand their role to be more of a strategic partner rather than just a health and welfare benefits administrator. They are investing in developing proprietary AI-based chatbots, decision support tools, and intelligent virtual assistants to help the participants make informed decisions. To address the trend of “consumerism,” service providers are expanding their services to offer a broader range of benefits, such as voluntary benefits, wellness programs, and Consumer-Driven Health Plans (CDHPs), as these play an increasingly important role in helping enterprises reinforce their employer brand to attract and retain top talent.

With the repeal of individual mandate and evolving healthcare ecosystem, it remains to be seen how the H&W BAO market reacts to these changes and what impact it will have on the various players in the market.

In this research, we analyze the H&W BAO market across various dimensions:

- H&W BAO market overview

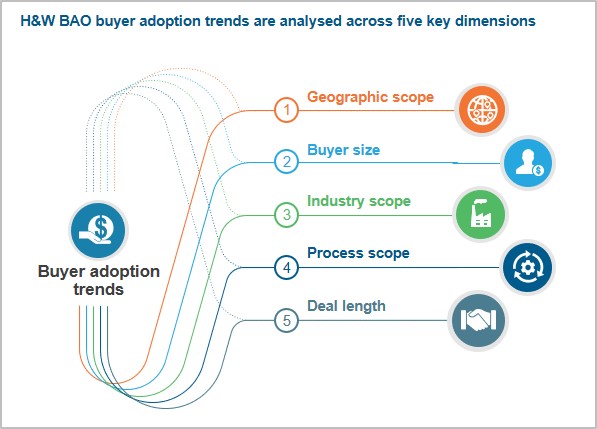

- Buyer adoption trends

- Solution and transaction trends

- Service provider landscape

Scope

- At least two core services in the H&W BAO value chain are outsourced

- Deal length is at least two years

- All industries and geographies

Content

This report provides a comprehensive coverage of the 2017 H&W BAO market and analyzes it across various dimensions such as market overview, buyer adoption trends, solution & transaction trends, and service provider landscape. Some of the findings in this report are:

- The H&W BAO market continues its steady growth of ~9% and has a market size of ~US$3.7 billion. H&W benefits administration outsourcing market accounts for ~45% of the overall BAO market (US$8-8.5 billion)

- Small market enterprises outpaced the other market segments to become the largest adopter of the H&W benefits administration outsourcing

- Most of the H&W BAO deals are local, single-country deals restricted to the United States. North America continues to be the largest adopter of H&W BAO, making up more than 90% of the market

- H&W BAO is an onshore-centric market with 85-90% of the FTEs in onshore locations. India and Southeast Asia are the preferred offshore locations

- The demand for consumerism is increasing at a rapid pace. Employers and employees are increasingly favoring voluntary benefits in the form of Consumer-Driven Health Plans (CDHPs) combined with spending accounts

- Service providers are focusing on their strengths and/or expanding their H&W capabilities, leading to M&As and realignment of strategies

Membership(s)

Human Resources Outsourcing (HRO)