|

|

Managed Service Provider (MSP) Annual Report 2018 – Towards the Next Frontier – Boldly Going Where Few Have Gone Before

18 Dec 2017

The global Managed Service Provider (MSP) market continued to remain one of the fastest-growing single-process HRO markets. It is expected to pose a high growth rate of 9-11% in 2017, backed by ever-increasing demand for contingent workers, rise in adoption of Statement of Work (SOW), and the emergence of the gig economy, resulting in rapidly-increasing numbers of freelancers/ICs. The growth has been particularly strong in the emerging markets of Asia Pacific, and is expected to touch 25-27% in 2017. The market is also undergoing a significant change as other service providers from the nosiness process outsourcing (BPO) and procurement outsourcing (PO) areas make inroads in what was earlier the exclusive domain of traditional MSP providers. This has been, in part, necessitated by the changing face of MSP, with a broadening of its scope to include SOW / services procurement as well.

In this research, we analyze the MSP market across various dimensions:

- State of the temporary labor market

- MSP market size and adoption

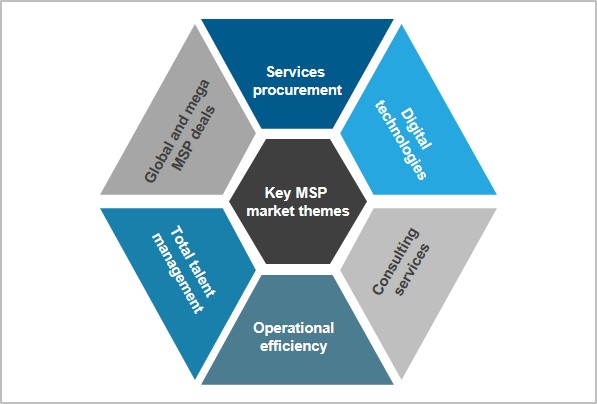

- Key MSP market themes

- Buyer adoption trends

SCOPE OF ANALYSIS

- A minimum of four MSP processes are included

- A minimum contract term of two years

- Scope of hires includes temporary/contingent hires, SOW consultants, and independent contractors

- All geographies, industries, and job families

The following service providers have been analysed as a part of this report: Agile•1, Allegis Global Solutions, AMN Healthcare, Capita Resourcing, Geometric Results Inc., Hays, Impellam Group, HCMWorks, KellyOCG, nextSource, Pontoon, PRO Unlimited, Randstad Sourceright, Broadleaf Results, Tapfin, Yoh, and ZeroChaos.

CONTENT

This research provides comprehensive coverage of the 2016-2017 MSP market and analyzes it across various dimensions such as market overview, evolving market situation, and buyer adoption trends. Some of the key findings are:

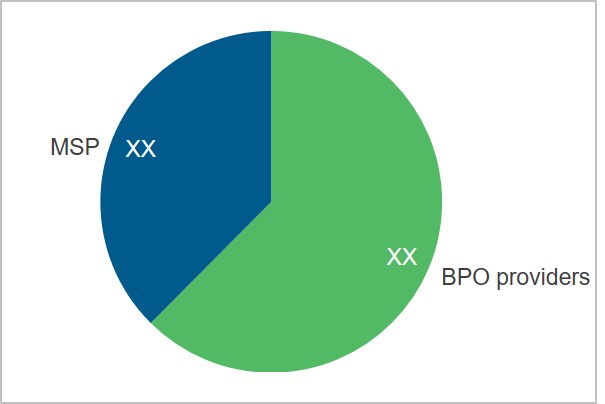

- The contingent workforce management industry continues to grow on the back of increasing demand for contingent labor from enterprises. BPO providers account for 62% of the contingent workforce managed spend, and MSP providers account for the remaining 38%

- Higher adoption of large and mega deals is fuelled by greater instances of multi-country deals and scope expansions for second- /third-generation buyers. Deals of both large and small duration saw their proportion increasing, while medium-duration deals saw their share shrinking

- Consulting and value-added services are becoming important as buyers are increasingly strategic in their approach towards talent acquisition. Service providers are now looking at providing a full-suite of consulting services either through an embedded approach or on a stand-alone basis

- Previously, for small organizations, neither the contingent workforce management (MSP) nor the permanent recruitment (RPO) were large enough to be outsourced. With the advent of a blended talent acquisition model, these small organizations now have the “critical size” to develop a viable business case for outsourcing talent acquisition-related functions

Membership(s) Managed Service Provider (MSP)

Page Count: 51

|

|