|

|

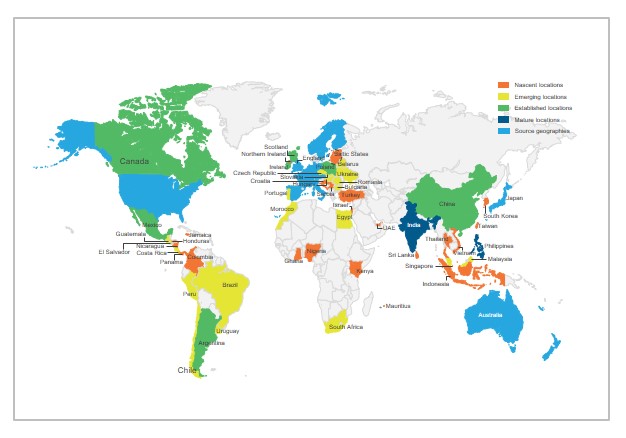

Global Locations Annual Report 2017: Signs of Structure in a Disordered World

30 Jun 2017

The global services locations landscape continued to witness stable growth in 2016 in terms of revenue; however, the growth rate was slower than the previous year owing to macroeconomic slowdown, political instabilities, and volatility in equity and investment markets. Similarly, the growth rate of center setups also dropped in 2016 in comparison to 2015.

This period continued to witness a shift from traditional locations; particularly, the share of India in terms of both center set-up activity and headcount reduced in 2016 as compared to some other locations in Nearshore Europe and Asia which witnessed increase in their respective shares. This year also saw increase in delivery of IT and engineering/R&D services as compared to business process services. In terms of disruptive technologies, service providers and enterprises are increasingly focusing on delivery of digital services – there has been significant growth over the past few years.

The Global Locations Annual Report 2017 is a unique and comprehensive guide to understanding the nuances of the global services locations landscape and interpreting locations-related developments and trends to frame locations strategy. It presents insights into the size and growth of the global services market, global services exports by region & country, update of locations activity by region & country, and trends affecting global locations (changes in investment environment and exposure to various risks). It also provides industry-leading comparison and analysis of key changes in maturity, arbitrage, and potential of global delivery locations (cities) through our unique MAP MatrixTM analysis.

Contents

The report contains four key sections:

- Global services market

- Update of the size and growth of the global services exports market by both revenue and headcount

- Delivery locations landscape by revenue and headcount

- Leading delivery locations by region (e.g., Asia Pacific, Nearshore Europe, Latin America, and Africa & Middle East)

- Locations activity

- An update of locations activity in 2016 by region

- Key trends in locations activity (e.g., functions supported, mix of tier-1 and tier-2/3 cities, breakup of activity by GICs & service providers, and breakup of activity by /offshore/nearshore/onshore locations)

- Growth in delivery of digital services by region

- Maturity | Arbitrage | Potential (MAP) MatrixTM: Objective, data-driven, and comparative assessment of locations specific to a market segment (function and process)

- Information Technology – Application Development and Maintenance (IT-ADM)

- Contact center (English language)

- Transactional Business Process Services (BPS)

- Complex / judgment-intensive BPS

- Bilingual (Spanish and English language) BPS

- Multilingual (European languages) BPS

- Analytics

- Digital services

- Engineering/R&D services

- IT services in the United States of America

Outlook on locations for each of the above categories

Risk watch by region (Asia Pacific, Americas, and Europe, Middle East, and Africa)

- Risk dashboard – Risk ratings across parameters, such as quality of infrastructure, safety & security, geopolitical, and macroeconomic environment for leading (offshore and nearshore) delivery locations across the region

- Updates on key changes in risk profiles for various delivery locations – important events in the past year that are likely to impact important delivery locations across the region (e.g., increased need for business continuity planning due to natural calamities and regulatory changes in India, political and macroeconomic instability in Brazil and Turkey, geopolitical tensions in Egypt, and weakening of major currencies as compared to the U.S. dollar)

- Key risks/opportunities to watch out for at various delivery locations across various regions (e.g., concerns around changes in political leadership in the Philippines, growing tensions between U.S. and Mexico over NAFTA, investor friendly reforms by government of Argentina, increasing leverage of India by engineering design companies, and delivery of digital technologies from tier-2 locations in Western Europe)

The report also provides data tables with details of new centers that were set up in 2016 for global services delivery.

Membership(s)

Locations Insider

Page Count: 197

|

|