|

|

Digital Expectations of Buyers Transforming the Service Provider Landscape – Insurance AO PEAK Matrix™ Assessment 2017 and Profiles Compendium

22 Sep 2017

by

Aaditya Jain, Archit Mishra, Jimit Arora, Ronak Doshi

The insurance sector is operating in an increasingly challenging macroeconomic and financial environment, characterized by weak global demand, low inflation rates, very low-to-partially negative interest rates, increasing regulatory compliance demands, and bursts of financial market volatility. Pervasiveness of digital technologies, rise of non-traditional competitors, and growing popularity of intermediated distribution networks is challenging the long-established traditional business model of insurers, and is prodding them to innovate in order to respond to the evolving customer demands.

With the insurers establishing efficient/agile operations and increasingly adopting digital technology themes, IT service providers are building their portfolio around next-generation technologies, and at the same time investing in strategic alliances with leading product/platform providers to strengthen their value proposition. As insurers evolve their product development ideology from a “one-size-fits-all” approach to an “on-demand hyper-personalized” approach, service providers that can indulge in a more consulting-led problem solving approach and partner with these enterprises on their business transformation journey, will see more success in the marketplace.

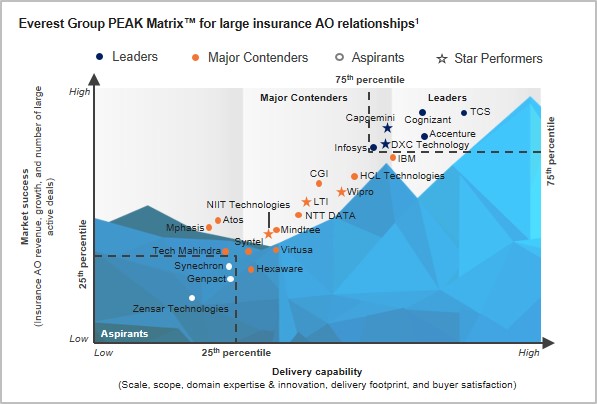

In this research, we analyze the capabilities of 23 leading AO service providers, specific to the global insurance sector. These providers were mapped on the Everest Group Performance | Experience | Ability | Knowledge (PEAK) Matrix, which is a composite index of a range of distinct metrics related to each provider’s capability and market success. In this report, we focus on:

- The landscape of service providers in insurance AO, L&P insurance AO, and P&C insurance AO

- Assessment of the service providers on a number of capability-related dimensions

- Characteristics of Leaders, Major Contenders, and Aspirants on the Everest Group insurance AO PEAK Matrix™

- “Star Performers” of 2017, providers with the strongest forward movement over time

- Implications for insurance buyers and service providers

Scope of the Analysis

- Market trends and activity for large AO relationships in insurance firms

- Insurance AO PEAK Matrix™ characteristics

- Insurance AO service provider characteristics

Content

This report analyzes IT applications outsourcing in the global insurance sector with a focus on large (TCV > US$25 million), annuity-based, multi-year (over three years) relationships:

- Insurance AO trends and its implications for key stakeholders

- Everest Group Performance | Experience | Ability | Knowledge (PEAK) Matrix for insurance AO

- Everest Group PEAK Matrix for life & pensions (L&P) insurance AO

- Everest Group PEAK Matrix for property & casualty (P&C) insurance AO

- Star Performers in the 2017 insurance AO PEAK Matrix

- Insurance AO PEAK Matrix characteristics:

- Scale

- Domain expertise and innovation

- Delivery footprint

- Market share

- Profiles of insurance AO service providers

Membership(s) Banking, Financial Services & Insurance (BFSI) - Information Technology Outsourcing (ITO)

Page Count: 128

|

|